Archives

IASbaba’s Daily Current Affairs – 19th April, 2016

ENVIRONMENT

TOPIC:General Studies 2:

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

- Conservation, environmental pollution and degradation, environmental impact assessment.

Clean Energy Investors—WANTED

Biggest challenge for the renewable energy sector in India— Absence of a financial ecosystem fit to purpose and fit to scale

Even as India has aggressively scaled up its renewable energy targets, the financial commitments have not kept pace. Hesitation among investors stems from many reasons:

- Need for large upfront capital and long-term debt;

- Worries about the credibility of contracts;

- Project delays;

- Uncertainty about revenue flows;

- Foreign exchange risk;

- Technology and product efficiency concerns

Reasons why India seems to be struggling—

No single pathway to achieving the targets, particularly vis-a-vis solar and biomass-based energy.

- Each pathway requires different financial models

- Much focus has been on trying to secure commitments for grid-scale projects (investments were up 80 per cent in 2015).

- But the Indian financial system has not innovated enough to move the needle on smaller scale and decentralised energy projects.

Renewable energy is often conflated with solar power:

Solar photovoltaic investments have now surpassed wind but there is also the risk of crowding out innovative (but riskier) financing for small hydropower or biomass-to-energy projects

Renewable energy is restricted to electricity:

- A number of policy announcements from the current government are directed largely to Re-based electricity whereas for cooking energy, much of the focus has been on rationalising government subsidies.

- Other applications - heating, cooling, and productive and mechanical power - have received less attention than lighting

Way Ahead:

- Different types of financial institutions (banks, non-bank financial companies, multilateral institutions, bilateral funding agencies, institutional investors) must envision their functional roles for different purposes –

Strategic level—priority sector lending, loan guarantees

Project level—credit enhancement, private equity

Ancillary support—evacuation infrastructure, skills, R&D

- Efforts need to be made to support some state governments in—

- Issuing green bonds – regulatory guidelines— restructuring one as a green bank

- Innovative ideas for RE finance

- Small-scale projects like rooftop

- Aggregation of projects to create investible portfolios for institutional investors

- Establishing terms on which these systems would integrate when the centralised grid extends its reach

- Find balance between rural projects (with likely more development co-benefits) and urban sites (where commercial opportunities to scale might be greater).

- Decentralised Clean Energy Sector needs to take care—

- Kick-starting new pilot projects or scaling a few interventions

- Garner clear metrics of success to consolidate the lessons of the past and determine which processes and innovations could be replicated across India

- Co-ordination between different levels of governance—

- Need to give attention to how respective policies interact and in particular to ensuring that regulations at the national (or federal) level complement those at the local (or state) level

- Harmonisation of clean energy policy priorities must carefully consider the needs of rural regions, which are more likely to be home to larger-scale renewable energy generation. National policies need to take into account the impact of renewable energy deployment on host communities and thereby, adopt a territorial approach to renewable energy deployment to avoid distortions in land use and relative prices in host communities.

- RE policy should link energy production to other industries such as farming, forestry, and traditional manufacturing.

- Regional authorities can foster social acceptance in two ways:

- Increasing understanding of renewable energy projects

- Ensuring local benefits, as communities will more willingly accept some of the costs of renewable energy installations if they stand to gain from such investment.

- Engaging in public-private partnerships— Attention should be given to

- Value-for-money and adequate risk-sharing

- Market sounding (which includes evaluating the strength of the private sector market for the project, the private sector's capacity for achieving economies of scale, and its relevant expertise), as well as the potential for risk transfer within the PPP

- Addressing these fiscal implications is particularly important in the case of PPPs for clean energy infrastructure in developing countries for two reasons:

- Because government may have to set aside public funds to support the clean energy infrastructure once it has started operating;

- Because pricing of the service has important implications for access to energy.

Connecting the Dots:

- What steps has the national government taken to align national and sub-national policies that could have an impact on investment in clean energy infrastructure?

INTERNATIONAL

TOPIC: General Studies 2:

- Bilateral, regional and global groupings and agreements involving India and/or affecting India's interests.

- Effect of policies and politics of developed and developing countries on India's interests, Indian diaspora.

- Important International institutions, agencies and fora- their structure, mandate.

G-20’s warning on the global economy:

Why in news?

- Recently Finance ministers and central bank governors of the G-20 countries met at Washington and issued a communiqué regarding global growth trends and outlook.

Communiqué: http://www.g20.utoronto.ca/2016/160415-finance.html

An important thing to note in the communiqué:

- According to the communiqué global growth “remains modest and uneven” and also G-20 warned the large advanced economies against continuing their prolonged, excessive reliance on unconventional monetary policy to power growth.

IMF and the world economic outlook:

- The G-20 meeting was held as the International Monetary Fund (IMF) released yet another downward revision of its outlook for global growth.

- Making the updated assessment even more difficult was the institution’s warning about the unusual range of risks, including the possible exit of the UK from the European Union, along with other political risks to financial volatility as well as the particular challenges facing commodity exporters.

A brief outlook of the report: http://www.imf.org/external/pubs/ft/weo/2016/update/01/

The disappointing outcome from the G-20 meet:

- The irony is that despite the unusually high degree of consensus on the outlook for the global economy and the policy implications, the G-20 again fell short of committing to a collective and verifiable set of actions that could spur measures at the national level.

This is particularly disappointing for two reasons:

- The G-20 has shown its ability to act; and when it has, the results were potent.

- Indeed, if it weren’t for the coordinated policy approach adopted by the G-20 at its meeting in London in April 2009, the world could have fallen into a devastating multi-year depression.

- However this coordinated policy approach is lacking now.

- With companies sitting on so much cash or devoting it exclusively to financial engineering, the unleashing of global growth does not need a “big bang” in terms of policies.

- A small bang would probably prove sufficient to unleash faster global recovery, with the private sector doing much of the heavy lifting by using its strong balance sheets to expand current and future output.

Sadder days ahead for the global economy:

- Sadly, the required policy response may only come with a further worsening of an already mediocre outlook for growth as well as deteriorating prospects for genuine financial stability.

- In the meantime, both excessive political dysfunction and alarming levels of inequality will remain high as the global economy languishes in a frustrating state of low growth.

Connecting the dots:

- Enumerate the list of various reports and their importance released by

- IMF

- World Bank

- World Economic Forum

- Critically examine the reasons for slowdown in the global economy with special reference to China.

MUST READHow to better the ‘new mediocre’- With the IMF paring down its global growth forecast, governments should first tweak economic policy to minimise vulnerabilities Hindu Defence preparedness: the way forward Hindu Related Articles: Towards Military self-reliance All India Radio- NEW DEFENCE PROCUREMENT POLICY The road not taken Hindu India, OIC and the Kashmir charade-Anyone familiar with the Organisation of Islamic Cooperation knows its prosaic routine on J&K. Indian Express A real game changer-Unified Payment Interface is a radical step forward Business Standard Related Articles: Unified Payment Interface— A step towards a cashless economy Cyber security sector to create a million jobs-Nasscom set up a task force last year, to position India as a global hub for providing cybersecurity solutions Business Standard Related Articles: Upgrading India’s cyber security architecture US, EU, Japan question India’s policy tweaks to restrict imports- Developed nations also ask why New Delhi is imposing minimum import prices, safeguard probes on steel products Live Mint Where are India’s female scientists?- More and more girls are taking up degrees in science, but only a few go on to pursue scientific careers Live Mint

MIND MAPS

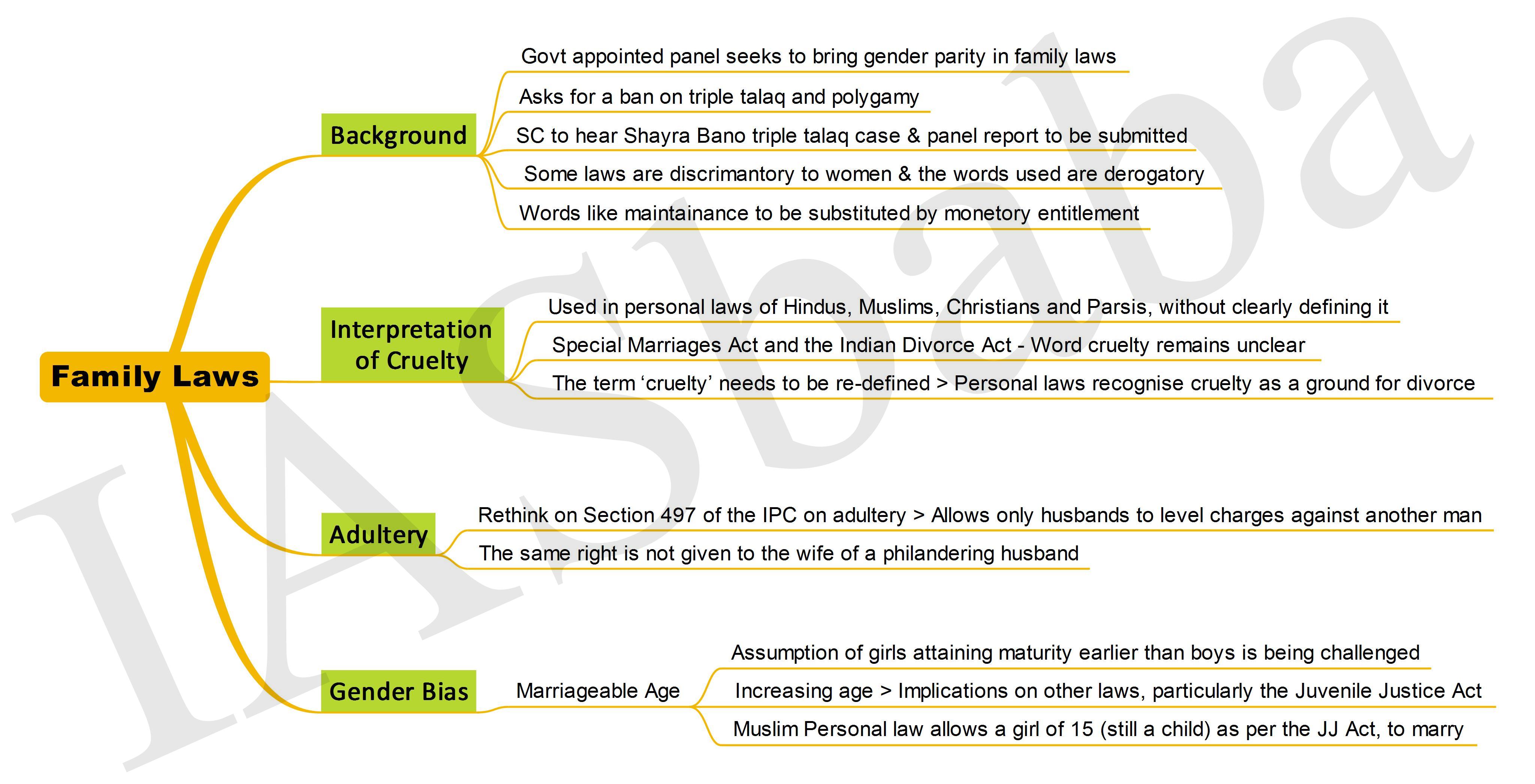

1. Family Laws