Key outcomes of 40th GST Council Meeting

Search 12th June, 2020 Spotlight here: http://www.newsonair.com/Main_Audio_Bulletins_Search.aspx

Topic: General Studies 3:

- Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

- Government Budgeting

In News: Federal indirect tax body, the Goods and Services Tax (GST) Council, held its 40th meeting by videoconference at a time central and state governments are facing severe cash crunch caused by the lockdown necessitated by the covid-19 pandemic. The meeting is also the first since the lockdown was imposed on 25 March.

The Government is faced with a tough balancing act, as on one hand it needs robust GST collections to help meet its regular and extraordinary expenses during the pandemic, while on the other hand, businesses are looking for relief to help them tide the major disruptions, loss of revenue and uncertainties.

Key Takeaways –

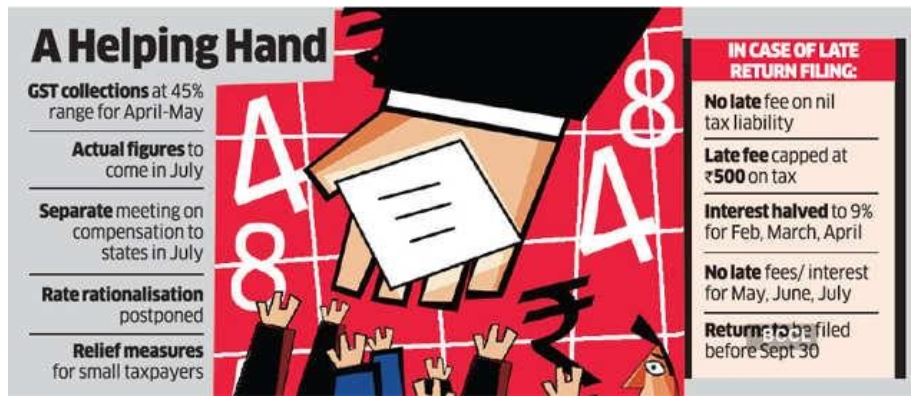

Reduction in late fee for past returns: As a measure to clean up pendency in return filing, the late fee for non-furnishing form GSTR-3B for the tax period July 2017 to January 2020 has been reduced/waived.

- No late fees will be levied on registered entities with nil GST return filing between July 2017 and January 2020.

- For people who have a tax liability, the maximum late fee for non-filing of GSTR-3B returns for period July 2017 to January has been capped at Rs 500.

- The reduced rate of late fee would apply for all the GSTR-3B returns furnished between July 1 and September 30.

Further relief for small taxpayers for March and April tax periods: For small taxpayers (aggregate turnover up to Rs 5 crore), the rate of interest for late furnishing of returns beyond specified dates (staggered up to July 6) reduced to 9 percent per annum from 18 percent till September 30.

For subsequent tax periods (May, June and July): Small taxpayers provided relief by waiver of late fees and interest if the returns in form GSTR-3B, for the supplies effected in May, June and July, are furnished by September.

One-time extension for seeking revocation of cancellation of registration: Taxpayers, who could not get their cancelled GST registrations restored in time, can file an application for revocation of cancellation of registration up to September 30. This applies to all cases where registrations have been cancelled till June 12.

The Council also deferred the decision of raising rates on textiles, fertilisers and footwear to correct the inverted duty structure. States unanimously agreed on the principal of correcting the inverted duty structure but also said that the it is not the right time to raise rates when the idea is to revive demand in the economy.

The next Council Meeting: The Council also decided to meet again in mid-July, to look into the issue of raising funds to meet the compensation requirements of states. The Council in will deliberate on the idea whether Centre can borrow funds from the market to pay off states dues.

Conclusion

- Removal of late fees for past returns is a big relief for those who are already facing severe cash crunch and this decision will be widely welcomed by small businesses. As the COVID scenario remains precarious, businesses need to closely review their functions and focus on adopting business continuity tools and technology. This way they can use this time to prepare for more pain, some of which may still come.

- However, there is no picture was given on how the future looks in terms of expectations of revenue collections.

Note:

About GST Council

- The GST Council is a constitutional body established under Article 279A of Indian Constitution

- It makes recommendations to the Union and State Government on issues related to Goods and Service Tax (GST).

- The GST Council is chaired by the Union Finance Minister.

Must Read: GST- Critical analysis of its working

Connecting the Dots:

- Have the GST collection measured up to expectations? Discuss.

- How can the gap between fund availability and fund requirement be bridged?