Initiatives in Textile Sector

Search 22nd October, 2018 Spotlight here: http://www.newsonair.com/Audio-Archive-Search.aspx

TOPIC: General Studies 3

- Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment.

- Inclusive growth and issues arising from it

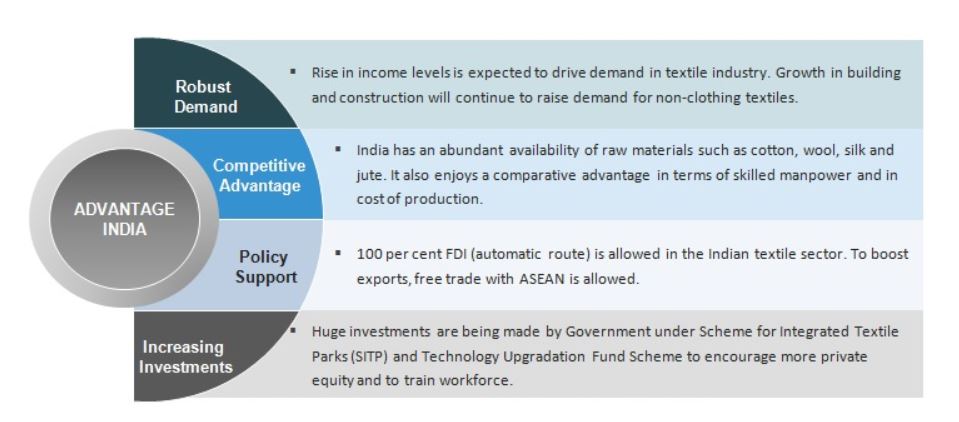

India’s textiles sector is one of the oldest industries in Indian economy dating back several centuries. India's overall textile exports during FY 2017-18 stood at US$ 39.2 billion.

The Indian textiles industry is extremely varied, with the hand-spun and hand-woven textiles sectors at one end of the spectrum, while the capital intensive sophisticated mills sector at the other end of the spectrum. The decentralised power looms/ hosiery and knitting sector form the largest component of the textiles sector.

The close linkage of the textile industry to agriculture (for raw materials such as cotton) and the ancient culture and traditions of the country in terms of textiles make the Indian textiles sector unique in comparison to the industries of other countries.

Target to double textile production by 2025

- The Textile Ministry is targeting to double textile production and trade to $300 billion by 2025.

- With the domestic production of textiles at $110 billion and exports and trade at $40 billion, the country’s production of textiles at present is worth $150 billion.

- To reach the target, the productivity and yield levels of both cotton fibre and synthetic will be stepped up.

India & Textiles

Refer: https://www.ibef.org/industry/textiles.aspx

Market Size

The Indian textiles industry, currently estimated at around US$ 150 billion, is expected to reach US$ 250 billion by 2019. India’s textiles industry contributed seven per cent of the industry output (in value terms) of India in 2017-18.It contributed two per cent to the GDP of India and employs more than 45 million people in 2017-18.The sector contributed 15 per cent to the export earnings of India in 2017-18. The production of raw cotton in India is estimated to have reached 34.9 million bales in FY18^.

Investment

The textiles sector has witnessed a spurt in investment during the last five years. The industry (including dyed and printed) attracted Foreign Direct Investment (FDI) worth US$ 2.97 billion during April 2000 to June 2018.

Some of the major investments in the Indian textiles industry are as follows:

- The Cabinet Committee on Economic Affairs (CCEA), Government of India has approved a new skill development scheme named 'Scheme for Capacity Building in Textile Sector (SCBTS)' with an outlay of Rs 1,300 crore (US$ 202.9 million) from 2017-18 to 2019-20.

- In May 2018, textiles sector recorded investments worth Rs 27,000 crore (US$ 4.19 billion) since June 2017.

Government Initiatives

The Indian government has come up with a number of export promotion policies for the textiles sector. It has also allowed 100 per cent FDI in the Indian textiles sector under the automatic route.

- The Textile Ministry of India earmarked Rs 690 crore (US$ 106.58 million) for setting up 21 readymade garment manufacturing units in seven states for development and modernisation of Indian Textile Sector.

- The Directorate General of Foreign Trade (DGFT) has revised rates for incentives under the Merchandise Exports from India Scheme (MEIS) for two subsectors of Textiles Industry - Readymade garments and Made ups - from 2 per cent to 4 per cent.

- As of August 2018, the Government of India has increased the basic custom duty to 20 per cent from 10 per cent on 501 textile products, to boost Make in India and indigenous production.

- The Government of India announced a Special Package to boost exports by US$ 31 billion, create one crore job opportunity and attract investments worth Rs 80,000 crore (US$ 11.93 billion) during 2018-2020. As of August 2018 it generated additional investments worth Rs 25,345 crore (US$ 3.78 billion) and exports worth Rs 57.28 billion (US$ 854.42 million).

- The Government of India has taken several measures including Amended Technology Up-gradation Fund Scheme (A-TUFS), scheme is estimated to create employment for 35 lakh people and enable investments worth Rs 95,000 crore (US$ 14.17 billion) by 2022.

- Setting up integrated textile parks: To assist small and medium entrepreneurs in the textile industry to clusterize investments in textile parks by providing financial support for world class infrastructure in the parks.

- Handlooms may be promoted with a focus on developing high-end niche products by linking it with contemporary fashion. Further, e-marketing initiatives will be pursued in order to cut down intermediaries and increase wage earnings of weavers. This would make handlooms attractive to younger generations as well. Promotion of handicrafts and handloom villages will be linked up with tourism, and traditional handloom weaver/handicraft artisan villages will be promoted as tourist destinations.

- Scheme for Capacity Building in Textile Sector: In order to ensure steady supply of skilled manpower in the labour-intensive textile sector, the Union Cabinet approved a Rs 1,300-crore outlay for skilling and up-skilling an estimated 10 lakh people in the entire value chain of the sector, including spinning and weaving. The scheme will provide demand-driven, placement-oriented skilling programme to incentivise the efforts of the industry in creating jobs in the organised textile and related sectors.

Challenges and Way Forward

First, yarn now attracts 5% GST and the machinery to manufacture yarn attracts 18%. This is uneven. Yarn manufacturers will be left with a huge input credit which they won’t be able to utilise. There is no provision under GST to get such accumulated credit as refund for capital goods. This will contribute to dead investment for the textile industry over several years.

Secondly, a foreign manufacturing company is now permitted to set up a unit without any investment from the domestic market, bring in 100% of their share, and repatriate profit to their countries. This has made the domestic textile machinery manufacturing companies to compete in an unfavourable environment. To safeguard the domestic industry’s interest, government should create a level-playing field which will pave the way for ‘Make in India’ to prosper.

This will also keep domestic industries healthy and will facilitate a healthy employment environment. Also, more incentives must be given to the textile sector to help explore the export market at competitive prices.

Thirdly, Government needs to conduct an impartial assessment of the contribution of handlooms to the domestic market. They need to evaluate the function of handloom in preventing migrations from the rural areas, creating skilled employment opportunities in the villages. Handloom should be supported on its own merits and not as a burden of heritage to be carried into the 21st century.

Finally, a simplified procedure is needed in the e-way bill legislation to ease transportation of goods by minimising documentation, physical verification and the like.

Connecting the Dots:

- Why textile sector remains an ailing sector in India? Analyse.

- The potential of textiles industry in India hasn’t been tapped to it’s full. Discuss. What steps can be taken to integrate this industry with the global supply chain.

- In the global supply chain of textiles, where does India stand? Is there any room of upgrading our position towards greater value addition? Examine. Also suggest strategies to meet this end?