Archives

(PRELIMS & MAINS Focus)

Syllabus:

- Prelims & Mains – ECONOMY

Context: The government is considering increasing the insurance cover for bank deposits from the current limit of Rs 5 lakh.

Background: –

- Deposit insurance was introduced in India in 1962, and coverage has thus far been enhanced six times – from Rs 1,500 per depositor held in the same right and same capacity at all the branches of the insured bank to Rs 5 lakh now.

Key takeaways

- The deposit insurance cover is offered by the Deposit Insurance and Credit Guarantee Corporation (DICGC), a specialised division of the Reserve Bank of India (RBI).

- The objective of the DICGC is to protect “small depositors” from the risk of losing their savings in case of a bank failure.

- The insurance cover of Rs 5 lakh per depositor is for all accounts held by the depositor in all branches of the insured bank.

- DICGC insures all commercial banks, including branches of foreign banks functioning in India, local area banks, regional rural banks, and cooperative banks. However, primary co-operative societies are not insured by the DICGC.

- Savings, fixed, current, and recurring deposits are insured. The DICGC does not provide insurance for deposits by foreign, central, and state governments, and for inter-bank deposits.

- The premium for deposit insurance is borne by the insured bank. DICGC collects premiums from member financial institutions at a flat or differentiated rate based on the bank’s risk profile.

How does the limit for DICGC’s insurance coverage work?

- In 2021, a new Section 18A was inserted in the DICGC Act, 1961, which enabled depositors to get interim payment and time-bound access to their deposits to the extent of the deposit insurance cover through interim payments by DICGC, in case of imposition of restrictions on banks by the RBI.

- At present, the DICGC offers insurance cover on bank deposits up to Rs 5 lakh within 90 days of imposition of such restrictions.

- Since the DICGC insures both the principal and interest amount held by a depositor in a bank, this is how the cover works:

- Say, a depositor has Rs 4,99,800 in her account, which includes the principal amount of Rs 4,90,000 and Rs 9,800 as interest accrued on it. In this case, the DICGC will provide insurance for Rs 4,99,800, which essentially means the depositors will get Rs 4,99,800 if their bank fails

- However, if the principal amount is Rs 5,00,000 (or more), and the interest accrued is Rs 10,000, the interest accrued will not be covered, as the depositor would have exhausted the cover limit of Rs 5 lakh.

- If the bank goes into liquidation, DICGC is liable to pay to the liquidator the claim amount of each depositor up to Rs 5 lakh within two months from the date of receipt of the claim list from the liquidator.

- The liquidator will have to disburse the right claim amount to each insured depositor.

Source: Indian Express

Syllabus:

- Prelims & Mains – SCIENCE & TECHNOLOGY

Context: Prime Minister Narendra Modi, on his visit to France to attend an AI summit, also toured the ambitious International Thermonuclear Experimental Reactor (ITER) in Cadarache, accompanied by French President Emmanuel Macron.

Background: –

- Prime Minister Modi’s visit to the ITER facility marks the first time that a Head of State or Head of Government has visited ITER.

Key takeaways

- ITER is an international collaborative project aimed at building the world’s largest magnetic fusion device, designed to prove the feasibility of fusion as a large-scale and carbon-free source of energy.

- Presently, as many as 33 nations, including India, are collaborating on ITER project. Seven ITER members — China, India, European Union, Japan, Korea, Russia and United States — have been making joint efforts for decades to build and operate the ITER experimental device.

- ITER is currently under construction in the south of France. According to its current timeline, it is expected to begin deuterium-tritium fusion reactions by 2039, producing 500 MW of fusion power.

- ITER would not be converting the output heat energy into electricity. But its success is expected to pave the way for other machines to start using fusion energy as a regular source of electricity generation.

- According to the ITER website, the primary task of ITER is to investigate and demonstrate burning plasmas — “plasmas in which the energy of the helium nuclei produced by the fusion reactions is enough to maintain the temperature of the plasma, thereby reducing or eliminating the need for external heating”.

Source: Indian Express

Syllabus:

- Prelims & Mains – GEOGRAPHY

Context: Delhi frequently experiences earthquakes, often originating from distant regions. However, the magnitude 4 earthquake that struck before dawn on Monday was distinct, as its epicenter was within Delhi itself, near Dhaula Kuan.

Background:

- Magnitude 4 earthquakes are not very strong, and do not result in much damage.

Key takeaways

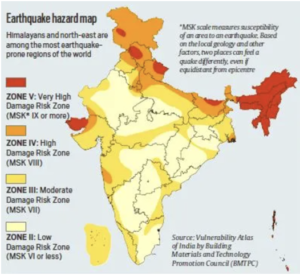

- Delhi lies in a seismically active area. India’s official earthquake hazard map puts Delhi in Zone 4, the second highest classification of areas based on their susceptibility to shaking experienced during an earthquake.

- Zone 4 in India includes areas that are expected to experience MSK-8-level intensity during an earthquake. The MSK, or Medvedev-Sponheuer-Karnik scale is a measure of intensity, rather than strength, or energy released, which is described by magnitude.

- Simply put, the MSK scale measures the susceptibility of an area to an earthquake. Based on the local geology and other factors, two places can feel, and be impacted by, a quake very differently, even if they are equidistant from its epicentre.

- Delhi falls in a region that has high susceptibility to quakes. MSK-8 means the area is vulnerable to major damage being caused to buildings and other infrastructure.

- Zone 5, the most vulnerable areas in India, correspond to MSK-9 levels of intensity or higher.

Aravalli-Delhi Fold Belt

- Delhi lies in what is known as the Aravalli-Delhi Fold Belt, a seismically-active geological belt extending from southern and eastern Rajasthan to Haryana and Delhi.

- This region is characterised by the presence of deformed layers of rock that have been folded or bent due to geological processes hundreds of millions of years ago. These deformities have created stress which is sometimes released in the form of earthquakes.

- This is a very different mechanism from the one that triggers earthquakes in the Himalayan region. The Himalayan region has been witnessing the subduction of the Indian tectonic plate under the Eurasian plate — one pushing against the other — which results in a lot of stress building up.

- The Aravalli-Delhi Fold Belt was much more seismically active in the past than it is now. Over the years, the tectonic activity in the region has slowed down considerably, leading to greater geological stability. But some faults still remain, which give rise to occasional mild earthquakes.

Source: Indian Express

Syllabus:

- Prelims – CURRENT EVENT

Context: India is in the final stages of preparing its first ever Biannual Transparency Report (BTR), part of its commitment as a signatory to the 2015 Paris Agreement on climate change.

Background: –

- The Biennial Transparency Report (BTR) is a reporting mechanism established under the Paris Agreement’s Enhanced Transparency Framework (ETF).

Key takeaways

- The report will be India’s official position on its greenhouse gas emissions inventory, key sectors and sources, and steps taken to improve energy efficiency use, as well as the transition to renewable energy sources and the availability of required resources.

- While India has been periodically submitting such information in the form of ‘national communications’ and ‘Biannual Update Reports’ (BUR), the BTR is a document that will be subject to technical review by independent, non-Indian, UNFCCC-accredited experts.

- The reports are part of the commitment made by all signatories at the UNFCCC’s 21st Conference of Parties (COP), held in Paris in 2015, in a bid to increase transparency. However, it was only at the 2024 COP in Baku that countries actually began submitting BTRs that adhered to the prescribed format.

- While all countries were to have submitted their BTRs by December 2024, several — including India — failed to meet that deadline.

Key Components of the BTR:

- National Inventory Report (NIR): An account of greenhouse gas emissions and removals.

- Progress on Nationally Determined Contributions (NDCs): Updates on efforts and achievements related to emission reduction targets.

- Policies and Measures: Descriptions of strategies implemented to mitigate climate change.

- Climate Change Impacts and Adaptation: Information on observed impacts and adaptation actions.

- Support Provided and Received: Details on financial, technological, and capacity-building assistance.

- Capacity-Building Needs and Areas for Improvement: Identification of areas requiring enhancement to effectively combat climate change. UNFCCC

Source: The Hindu

Syllabus:

- Prelims & Mains – CURRENT EVENT

Context: The Government of India approved the continuation of the integrated Pradhan Mantri Annadata Aay Sanrakshan Abhiyan (PM-AASHA) Scheme during the 15th Finance Commission Cycle up to 2025-26.

Background: –

- The scheme aims to strengthen the procurement mechanism in coordination with state governments, thereby safeguarding farmers’ income and stabilizing the agricultural market.

Key takeaways

- The Pradhan Mantri Annadata Aay Sanrakshan Abhiyan (PM-AASHA) is an umbrella scheme launched by the Government of India in 2018 to ensure remunerative prices for farmers’ produce.

Key Components of PM-AASHA:-

Price Support Scheme (PSS):

- Objective: Procurement of notified pulses, oilseeds, and copra directly from farmers at Minimum Support Prices (MSP) when market prices fall below MSP.

- Implementation: Central Nodal Agencies (CNAs) like the National Agricultural Cooperative Marketing Federation of India (NAFED) undertake procurement in collaboration with state-level agencies.

- Procurement Limit: From the 2024-25 season onwards, procurement is set at 25% of the national production for the notified crops. However, for Tur (Arhar), Urad, and Masur, 100% procurement is allowed for the 2024-25 season to encourage domestic production and reduce import dependence.

Price Deficiency Payment Scheme (PDPS):

- Objective: To compensate farmers for the difference between the MSP and the actual selling price of oilseeds, without physical procurement.

- Implementation: Farmers receive direct payments of the price difference, with the central government bearing up to 15% of the MSP as compensation.

- Coverage Expansion: The scheme’s coverage has been enhanced from 25% to 40% of the state’s oilseed production, and the implementation period extended from 3 to 4 months to benefit more farmers.

Pilot of Private Procurement & Stockist Scheme (PPPS):

- Objective: To involve the private sector in the procurement of oilseeds on a pilot basis in selected districts.

- Implementation: Private agencies procure oilseeds at MSP in designated markets during the notified period, aiming to increase efficiency and reduce the burden on public procurement systems.

Source: PIB

Practice MCQs

Q1.) Which of the following statements regarding earthquakes in Delhi is/are correct?

- Delhi falls under Seismic Zone 5, the most earthquake-prone classification in India.

- The recent magnitude 4 earthquake in Delhi had its epicenter within the city, near Dhaula Kuan.

- The Aravalli-Delhi Fold Belt is a major seismically active zone due to the continuous subduction of tectonic plates.

Select the correct answer using the codes given below:

(a) 1 and 2 only

(b) 1, 2, and 3

(c) 1 and 3 only

(d) 2 only

Q2.) Which of the following statements about the Biannual Transparency Report (BTR) is/are correct?

- The BTR is a part of the Enhanced Transparency Framework (ETF) under the Paris Agreement.

- India has been submitting BTRs since 2015 as part of its Nationally Determined Contributions (NDCs).

- The BTR includes details on greenhouse gas emissions, climate change mitigation measures, and financial support received for climate action.

Select the correct answer using the codes given below:

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2, and 3

Q3.) Consider the following statements regarding the PM-AASHA scheme:

- The scheme includes a Price Support Scheme (PSS) under which oilseeds and pulses are procured directly from farmers at Minimum Support Prices (MSP).

- The Price Deficiency Payment Scheme (PDPS) under PM-AASHA provides direct compensation to farmers without physical procurement of crops.

- The Pilot of Private Procurement & Stockist Scheme (PPPS) allows private players to procure wheat and rice at MSP to reduce government procurement burden.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2, and 3

Comment the answers to the above questions in the comment section below!!

ANSWERS FOR ’ Today’s – Daily Practice MCQs’ will be updated along with tomorrow’s Daily Current Affairs

ANSWERS FOR 18th February – Daily Practice MCQs

Q.1) – c

Q.2) – a

Q.3) – a