Archives

(PRELIMS & MAINS Focus)

Syllabus

- Prelims : Centrally Sponsored Schemes

Context: Union Minister of Health and Family Welfare Dr. Mansukh Mandaviya delivered the inaugural address at the National AYUSH Mission Conclave organized by Ministry of AYUSH.

About National AYUSH Mission

- National AYUSH Mission is a Centraly Sponsored Scheme under the Ministry of AYUSH.

- Government of India has launched National AYUSH Mission (NAM) in 2014.

- The aims of NAM are to main-stream AYUSH Systems into health care services, to develop evidence-based AYUSH management protocol through scientific documentation and to ensure the accessibility of quality AYUSH services.

- Funding pattern: 60% share is provided by the Central Government and 40% is provided by the State Government.

Structure

- State level: NAM is functioning under State AYUSH Health Society which is regulated by a Governing Body with Chief Secretary as Chairperson and Secretary, AYUSH as Member Secretary.

- The Executive Committee under this society, with Secretary, AYUSH as Chairperson and State Mission Director (SMD), NAM as Member Secretary, is managing routine activities.

- NAM has State Program Management and Supporting Unit (SPMSU) functioning under State Mission Director who is an IAS officer.

- State level functions are co-ordinated by two State Program Managers, one each from Ayurveda and Homoeopathy.

- District level: District Program Management and Supporting Unit (DPMSU) is managed by District Program Managers (DPM).

- In the Governing Body of District AYUSH Health Society, President of concerned District Panchayath is the Chairperson & District Collector is the Co-chairperson and DPM NAM is the Member Secretary.

- Executive Committee of District AYUSH Health Society is chaired by District Collector and NAM DPM is the Member Secretary.

Objectives

- To provide cost effective AYUSH Services, with a universal access through upgrading AYUSH Hospitals and Dispensaries, co-location of AYUSH facilities at Primary Health Centres (PHCs), Community Health Centres (CHCs) and District Hospitals (DHs).

- To strengthen institutional capacity at the state level through upgrading AYUSH educational institutions, State Govt. ASU&H Pharmacies, Drug Testing Laboratories and ASU & H enforcement mechanism.

- Support cultivation of medicinal plants by adopting Good Agricultural Practices (GAPs) so as to provide sustained supply of quality raw-materials and support certification mechanism for quality standards, Good Agricultural/Collection/Storage Practices.

- Support setting up of clusters through convergence of cultivation, warehousing, value addition and marketing and development of infrastructure for entrepreneurs.

Components of the Mission

- Mandatory Components

- AYUSH Services.

- AYUSH Educational Institutions.

- Quality Control of ASU&H (Ayurveda, Siddha and Unani & Homoeopathy) Drugs.

- Medicinal Plants.

- Flexible Component

- AYUSH Wellness Centres comprising Yoga and Naturopathy

- Tele-medicine

- Innovations in AYUSH including Public Private Partnership

- IEC (Information, Education and Communication) activities

- Voluntary certification scheme: Project based, etc.

MUST READ : AYUSH Health and Wellness Centers (HWC) https://iasbaba.com/2020/03/ayush-wellness-centre-to-come-under-nam/

SOURCE: PIB https://pib.gov.in/PressReleasePage.aspx?PRID=1925182

Syllabus

- Prelims: Economy

Context: Recently, the Reserve Bank of India came up with a regulatory framework for banks to accept green deposits from customers.

About Green Deposits

- A green deposit is a fixed-term deposit for investors looking to invest their surplus cash reserves in environmentally friendly projects.

- This new offering in the market indicates the increased awareness of the importance of ESG (Environmental, social and governance) and sustainable investing.

- Green deposits are not very different from the regular deposits that banks accept from their customers.

- The only major difference is that banks promise to earmark the money that they receive as green deposits towards environment-friendly projects.

- For example, a bank may promise that green deposits will be used towards financing renewable energy projects that fight climate change.

- A green deposit is just one product in a wide array of other financial products such as green bonds that help investors put money into environmentally sustainable projects.

Regulatory Framework

- The RBI’s framework for the acceptance of green deposits lays down certain conditions that banks must fulfill to accept green deposits from customers.

- Banks will have to come up with a set of rules or policies approved by their respective Boards that need to be followed while investing green deposits from customers.

- The RBI has come up with a list of sectors that can be classified as sustainable and thus eligible to receive green deposits. These include renewable energy, waste management, clean transportation, energy efficiency, and afforestation.

- Banks will be barred from investing green deposits in business projects involving fossil fuels, nuclear power, tobacco, gambling, palm oil and hydropower generation.

- The new rules are aimed at preventing greenwashing, which refers to making misleading claims about the positive environmental impact of an activity.

- The framework applies to all scheduled commercial banks and small finance banks (except for regional rural banks and local area banks) and non-banking finance companies (including housing finance companies). Both corporate and individual customers can invest in green deposits.

MUST READ: Green Washing https://iasbaba.com/2022/11/greenwashing/

SOURCE: The Hindu https://www.thehindu.com/opinion/op-ed/explained-what-are-rbi-regulations-on-green-deposits/article66866265.ece

PREVIOUS YEAR QUESTION

Q.1) Which one of the following best describes the term “greenwashing:”?

- Conveying a false impression that a company’s products are eco-friendly and environmentally sound.

- Non-Inclusion of ecological/ environmental costs in the Annual Financial Statements of a country.

- Ignoring the disastrous ecological consequences while undertaking infrastructure development.

- Making mandatory provisions for environmental costs in a government project/programme.

Syllabus

- Prelims : Economy

Context : The Central Government, in consultation with the Reserve Bank of India amended rules under the Foreign Exchange Management Act, bringing in international credit card spends outside India under the Liberalised Remittance Scheme (LRS).

About Liberalised Remittance Scheme (LRS)

- In 2004, the Committee on Procedures and Performance Audit on Public Services (‘CPPAPS’) recommended a scheme for liberalising personal outward remittances in India.

- The same year, RBI introduced the Liberalised Remittance Scheme (‘LRS’), allowing Indian residents to make individual foreign exchange transactions with relative ease.

- LRS allows Indian residents to freely remit up to USD $250,000 per financial year for current or capital account transactions or a combination of both. Any remittance exceeding this limit requires prior permission from the RBI.

- Only individual Indian residents are permitted to remit funds under LRS. Corporates, partnership firms, HUF, trusts, etc are excluded from its ambit. However, it is available to minors, provided that Form A2 is countersigned by the minor’s natural guardian.

Types of transactions permitted under LRS

- Capital account transactions:

- Opening of foreign currency account abroad with a bank;

- Acquisition of immovable property abroad,

- overseas direct investment (ODI) and overseas portfolio investment (OPI), in accordance with the Foreign Exchange Management (Overseas Investment) Rules, 2022, Foreign Exchange Management (Overseas Investment) Regulations,2022 and Foreign Exchange Management (Overseas Investment) Directions, 2022;

- Extending loans, including loans in Indian Rupees to non-resident Indians (NRIs) who are relatives as defined in the Companies Act, 2013.

Current account transactions:

- Private visits abroad (excluding Nepal and Bhutan)

- Gifts/donations

- Going abroad on employment

- Emigration

- Maintenance of relatives abroad

- Business trips

- Medical treatment abroad

- Pursuing studies abroad

- Other permissible transactions include purchasing objects of art subject to the provisions of other applicable laws such as the extant Foreign Trade Policy of the Government of India.

Types of transactions prohibited under LRS

- Transactions not permissible under Foreign Exchange Management Act, 1999

- Remittance for margins or margin calls to overseas exchanges or overseas counterparty

- Remittances for any purpose specifically prohibited under Schedule I or any item restricted under Schedule II of Foreign Exchange Management (Current Account Transaction) Rules, 2000.

- Capital account remittances to countries identified by Financial Action Task Force (FATF) as non-co-operative countries and territories or as notified by RBI

- Remittances directly or indirectly to those individuals and entities identified as posing significant risk of committing acts of terrorism as advised separately by RBI to the banks

Tax Obligations

- Tax collected on source (TCS) is levied at the rate of 5% on all remittances above the threshold of Rs 7 lakh. However, the TCS deducted can be claimed as a refund at the time of filing income tax return (ITR) under Form 26 AS.

- If any profit is made on foreign investments made under LRS, it is taxable in India based on how long the investment was held. If the investment was for 24+ months, a long-term capital gains tax of 20% is imposed. Otherwise, gains from these investments are treated as normal income and taxed as per the applicable tax slabs.

MUST READ: Foreign Exchange Management Act, 1999 https://iasbaba.com/2022/12/foreign-exchange-management-act/

SOURCE: Economic Times (LRS)

Syllabus

- Prelims: Economics

Context: Indian Renewable Energy Development Agency Ltd. (IREDA) emphasized the need for avoided carbon emissions via reduced generation and utilization of power from conventional sources at CEO Round Table in Bangkok, Thailand.

About Indian Renewable Energy Development Agency

- Indian Renewable Energy Development Agency Limited (IREDA) is a Mini Ratna (Category – I) Government of India Enterprise under the administrative control of Ministry of New and Renewable Energy (MNRE).

- IREDA is a Public Limited Government Company established as a Non-Banking Financial Institution in 1987 engaged in promoting, developing and extending financial assistance for setting up projects relating to new and renewable sources of energy and energy efficiency/conservation.

- The Indian Renewable Energy Development Agency (IREDA) offers a credit enhancement guarantee scheme to support the issuance of bonds by wind and solar energy project developers.

- By providing unconditional and irrevocable partial credit guarantees, IREDA aims to enhance the credit rating of bonds for renewable energy projects, thereby improving their marketability and liquidity, and attracting lower-cost and longer-term funding for project developers. The amount raised by credit enhanced bonds shall only serve to repay existing debt partially or fully.

- IREDA’s long-term objective is to contribute to the development of a bond market for renewable energy projects in India.

MUST READ: One Sun One World One Grid initiative

SOURCE: PIB https://www.pib.gov.in/PressReleasePage.aspx?PRID=1925552

PREVIOUS YEAR QUESTION

Q.1) With reference to the Indian Renewable Energy Development Agency Limited (IREDA), which of the following statements is/are correct? (2015)

- It is a Public Limited Government Company.

- It is a Non-Banking Financial Company.

Select the correct answer using the code given below.

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Syllabus

- Prelims : Economics

Context: The Central Bureau of Investigation searched 12 locations in Delhi and Rajasthan in connection with a case alleging corruption in the award of civil works related to the Kiru hydro-electric power project in Jammu and Kashmir.

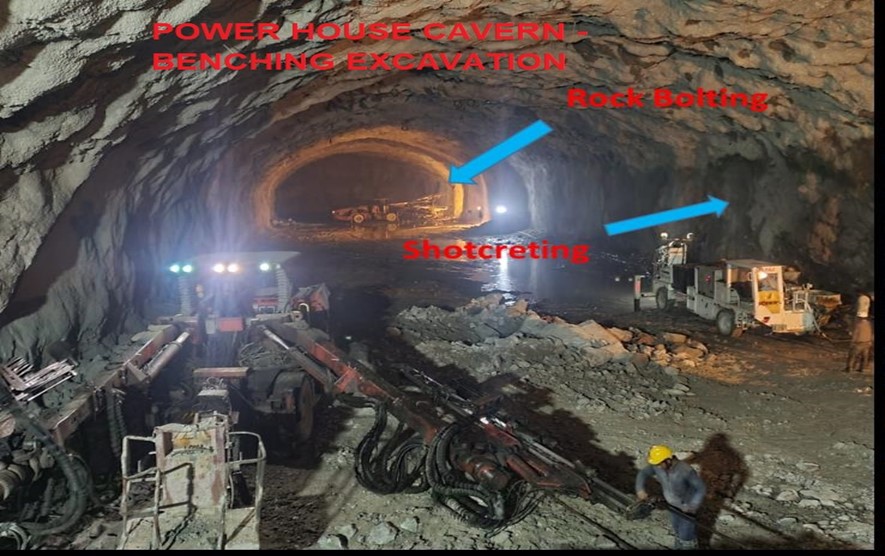

About Kiru Hydro-Electric Power Project

IMAGE SOURCE http://www.nhpcindia.com

- Kiru Hydro Electric Project is proposed on River Chenab, located in Kishtwar district of the Jammu & Kashmir.

- The project is envisaged as a Run of River Scheme & designed complying with the requirements of Indus Water Treaty 1960.

- The project is being developed by Chenab Valley Power Projects, a joint venture between National Hydroelectric Power Corporation, Jammu & Kashmir State Power Development Corporation and Power Trading Corporation.

- The project will address the energy deficiency in the Northern region of India.

- It will simultaneously improve the transportation, education, medical, and road transportation network in the region.

- The power plant will bring electricity to the rural area, which will reduce the dependency of the locals on alternative sources of energy.

- Increased power supply in the region will enhance the development of small-scale and cottage industries in the region, which will in turn, provide jobs and revenue to the locals.

MUST READ: Hydro Electric Projects in India

SOURCE: The Hindu https://www.thehindu.com/news/national/insurance-scam-case-cbi-searches-at-nine-locations-in-jammu-and-kashmir-delhi/article66860030.ece

Syllabus

- Prelims – Economy

Context: Tata Consumer Products on Tuesday said that it will delist its global depository receipts (GDRs) from the London Stock Exchange and Luxembourg Stock Exchange from June 23 this year.

What is a Depository?

- A depositary is an independent, third-party entity such as a bank that may act as a safekeeping facility and fiduciary. For instance, a depositary bank can provide stock related services for a depositary receipt program.

About Global Depository Receipts

- A global depositary receipt is a type of bank certificate that represents shares of stock in an international company.

- The shares underlying the GDR remain on deposit with a depositary bank or custodial institution.

- GDRs are commonly used by issuers to raise capital from international investors through private placement or public stock offerings.

- A global depositary receipt is very similar to an American depositary receipt (ADR) except that an ADR only lists shares of a foreign company in U.S. markets.

- GDRs make it possible for a company (the issuer) to access investors in capital markets beyond the borders of its own country.

- Different GDRs may also have specific characteristics that differ from one to the next. These may include:

- Conversion ratio: The conversion ratio is the number of shares of the underlying company that are represented by each GDR. This ratio can vary from one GDR to another.

- Denomination: GDRs can be denominated in different currencies, such as U.S. dollars, euros, or pounds sterling. The currency used for a GDR may impact its price and the risks associated with the investment, such as currency risk, as the price of its shares overseas are priced in local currency.

- Sponsorship: GDRs are issued by depository banks, and the specific bank that sponsors a GDR may vary from one GDR to another. Different banks may have different reputations, financial strength, and other characteristics that could impact the risks and potential returns of a GDR.

- Fees: GDRs may also vary in terms of the fees that are charged for issuing, trading, or holding the GDRs. These fees can impact the overall cost and potential returns of an investment in a GDR.

American Depository Receipts

- It is a form of equity security that was created specifically to simplify foreign investing for American investors.

- An ADR is issued by an American bank or broker.

- It represents one or more shares of foreign-company stock held by that bank in the home stock market of the foreign company.

Indian Depository Receipts (IDR)

- An IDR is in Indian rupees and is created by a domestic depository (custodian of securities registered with SEBI (Securities and Exchange Board of India).

- It is issued against the underlying equity of the company to enable foreign companies to raise funds from the Indian securities Markets.

MUST READ: FPI and InvITs https://iasbaba.com/2021/11/fpi-and-invits/

SOURCE: The Hindu Business Line https://www.thehindubusinessline.com/markets/tata-consumer-products-to-delist-gdrs-from-june-23/article66858443.ece

PREVIOUS YEAR QUESTIONS

Q.1) Consider the following: (2021)

- Foreign currency convertible bonds

- Foreign institutional investment with certain conditions

- Global depository receipts

- Non-resident external deposits

Which of the above can be included in Foreign Direct Investments?

- 1, 2 and 3

- 3 only

- 2 and 4 only

- 1 and 4 only

Q.2) Which of the following would include Foreign Direct Investment in India? (2012)

- Subsidiaries of foreign companies in India

- Majority of foreign equity holding in Indian companies

- Companies exclusively financed by foreign companies

- Portfolio investment

Select the correct answer using the codes given below:

- 1, 2, 3 and 4

- 2 and 4 only

- 1 and 3 only

- 1, 2 and 3

Syllabus

- Prelims – Governance

Context: NIA, along with Haryana Police and Punjab Police, conducted a joint crackdown across eight states on terrorist-gangster-drugs nexus case under the codename ‘Operation Dhvast’.

About Operation Dhvast

- ‘Operation Dhvast’ launched by National Investigation Agency across eight states in the terrorist-gangster-drug smugglers’ network cases.

- The focus of the raids was on weapon suppliers, financiers, logistic providers and hawala operators associated with the hardcore gangs working with drug smugglers and terrorists based out of other countries like Pakistan and Canada.

- NIA investigations have revealed that the conspiracies were being hatched in jails of different states and were being executed by an organised network of operators based abroad.

- The spotlight on these gangs has become sharper after reports of several prisons becoming havens of the deadly nexus and hubs of gang wars, which recently resulted in violence and murder inside Goindwal Jail and Tihar Jail

About National Investigation Agency (NIA)

- National Investigation Agency (NIA) is functioning as the Central Counter Terrorism Law Enforcement Agency in the country.

- The agency is empowered to deal with the investigation of terror related crimes across states without special permission from the states under written proclamation from the Ministry of Home Affairs.

- In the wake of the 26/11 Mumbai terror attack in November 2008, which shocked the entire world, the then United Progressive Alliance government decided to establish the NIA. In December 2008, former Union Home Minister P. Chidambaram introduced the National Investigation Agency Bill.

- The NIA Act was enacted on 31-12-08 and the National Investigation Agency (NIA) was born.

- The NIA aims to set the standards of excellence in counter terrorism and other national security related investigations at the national level by developing into a highly trained, partnership-oriented workforce.

Jurisdiction of NIA

- The law under which the agency operates extends

- to the whole of India and also applies to Indian citizens outside the country;

- persons in the service of the government wherever they are posted;

- persons on ships and aircraft registered in India wherever they may be;

- persons who commit a scheduled offence beyond India against the Indian citizen or affecting the interest of India.

- The Scheduled Offences in the NIA Act includes

- the Explosive Substances Act,

- Atomic Energy Act,

- Unlawful Activities (Prevention) Act,

- Anti-Hijacking Act,

- Suppression of Unlawful Acts against Safety of Civil Aviation Act,

- SAARC Convention (Suppression of Terrorism) Act,

- Suppression of Unlawful Acts Against Safety of Maritime Navigation and Fixed Platforms on Continental Shelf Act,

- Weapons of Mass Destruction and their Delivery Systems (Prohibition of Unlawful Activities) Act and relevant offences under the Indian Penal Code,

- Arms Act and

- the Information Technology Act.

How does the NIA take up a probe?

- State governments can refer the cases pertaining to the scheduled offences registered at any police station to the Central government (Union Home Ministry) for NIA investigation. After assessing the details made available, the Centre can then direct the agency to take over the case.

- State governments are required to extend all assistance to the NIA.

- Even when the Central government is of the opinion that a scheduled offence has been committed which is required to be investigated under the Act, it may, suo motu, direct the agency to take up/over the probe.

- Where the Central government finds that a scheduled offence has been committed at any place outside India to which this Act extends, it can also direct the NIA to register the case and take up investigation.

- While investigating any scheduled offence, the agency can also investigate any other offence which the accused is alleged to have committed if the offence is connected to the scheduled offence.

- Under the Act Various Special Courts have been notified by the Govt. of India for trial of the cases arising out of offences committed in various states of the Union.

SOURCE: India Today https://www.indiatoday.in/india/story/operation-dhwast-nia-mega-crackdown-8-states-gangster-and-terrorist-2380611-2023-05-17

Syllabus

- Prelims -Economy

Context: The European Bank for Reconstruction and Development pledged further support for war-torn Ukraine as shareholders consider a proposal to boost EBRD capital by 3 billion-5 billion euros.

About European Bank for Reconstruction and Development

- European Bank for Reconstruction and Development (EBRD) is a multilateral financial institution established in 1991.

- The organization was developed to help Eastern European and ex-Soviet countries transitioning into democracies by developing free-market economies after the fall of communism.

- EBRD is headquartered in London, United Kingdom.

- It is publicly owned by shareholders in 69 countries. It only supports countries that are committed to democratic principles

- The bank finances large and small projects in a variety of sectors including public works, agribusiness, natural resources, and municipal infrastructure.

- Organization does not finance projects related to the tobacco industry, defense, certain alcoholic products, stand-alone gambling facilities, or substances banned by international law.

- Despite its public sector shareholders, it invests mainly in private enterprises, together with commercial partners.

- India has become the 69th shareholder of the European Bank for Reconstruction and Development (EBRD). This move will enable Indian companies to undertake joint investments in regions in which the EBRD operates.

MUST READ: New Development Bank https://iasbaba.com/2021/12/new-development-bank-2/

https://iasbaba.com/2022/01/asian-infrastructure-investment-bank-aiib/

SOURCE: The Print https://theprint.in/world/ebrd-pledges-more-support-for-ukraine-eyes-capital-boost/1581166/

PREVIOUS YEAR QUESTIONS

Q.1) With reference to Asian Infrastructure Investment Bank (AIIB) consider the following statements: (2019)

- AIIB has more than 80 member nations.

- India is the largest shareholder in AIIB.

- AIIB does not have members from outside Asia

Which of the statements given above is/are correct?

- 1 only

- 2 and 3 only

- 1 and 3 only

- 1, 2 and 3

Q.2) Consider the following statements:

- New Development Bank has been set up by APEC.

- The headquarters of New Development Bank is in Shanghai.

Which of the statements given above is/are correct?

- 1only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Syllabus

- Mains – (Polity and Governance)

Context: The government recently cleared the appointment of two judges to the Supreme Court. The two new apex court judges are Justice Prashant Kumar Mishra and K.V. Viswanathan, who is a direct appointment from the Supreme Court Bar.

About Appointment of Judges:

- Judges of the High Courts and the Supreme Court are appointed by the provisions mentioned in Articles 124 and 217 of the Constitution of India.

- Articles 124 and 217 state that the President shall appoint judges to the Supreme Court and high courts after consultation with the Chief Justice of India and other judges.

- The current strength of the Supreme Court Judge is

- The Union Minister of Law, Justice, and Corporate Affairs would receive the Chief Justice of India’s request and recommendation to fill the vacancy whenever a vacancy arises in the position of a Supreme Court judge.

Collegium System:

Composition:

- The Supreme Court Collegium consists of the CJI and four senior-most judges of the apex court.

- High Court Collegium consists of the Chief Justice of the High Court and two senior-most judges of that particular court.

- It is the system of appointment and transfer of judges that has evolved through judgments of the Supreme Court, and not by an Act of Parliament or by a provision of the Constitution.

- The Supreme Court collegium is headed by the Chief Justice of India and comprises four other senior-most judges of the court.

- A High Court collegium is led by its Chief Justice and four other senior-most judges of that court.

- Names recommended for appointment by a High Court collegium reaches the government only after approval by the CJI and the Supreme Court collegium.

- Judges of the higher judiciary are appointed only through the collegium system, and the government has a role only after names have been decided by the collegium.

Evolution of the collegium system:

The collegium system has its genesis in a series of Supreme Court judgments called the ‘Judges Cases’.

FIRST JUDGES CASE:

- In S P Gupta Vs Union of India, 1981, the Supreme Court judgement held that consultation does not mean concurrence and it only implies an exchange of views.

SECOND JUDGES CASE:

- In The Supreme Court Advocates-on-Record Association Vs Union of India, 1993, a nine-judge Constitution Bench overruled the decision and devised a specific procedure called ‘Collegium System’ for the appointment and transfer of judges in the higher judiciary.

THIRD JUDGES CASE:

- In the Third Judges case (1998), the Court opined that the consultation process to be adopted by the Chief Justice of India requires ‘consultation of plurality judges’.

- The sole opinion of the CJI does not constitute the consultation process.

- He should consult a collegium of four senior-most judges of the Supreme Court and even if two judges give an adverse opinion, he should not send the recommendation to the government.

- The court held that the recommendation made by the chief justice of India without complying with the norms and requirements of the consultation process is not binding on the government.

Issues with the current collegium system:

- The collegium system does not provide any guidelines or criteria for the appointment of the Supreme Court judges and it increases the ambit of favouritism.

- In the collegium system, there are no criteria for testing the candidate or for doing a background check to establish the credibility of the candidate.

- The absence of an administrative body is also a reason for worry because it means that the members of the collegium system are not answerable for the selection of any of the judges.

Attempts to reform the Appointment System:

About National Judicial Appointments Commission (NJAC)

- 99thConstitution Amendment Act: It introduced three key Articles- 124 A, B, and C and amended clause 2 of Article 124.

- Article 124A created the National Judicial Appointments Commission (NJAC), a constitutional body to replace the collegium system.

- Article 124B vested in this NJAC the power to make appointments to both the Supreme Court and the various high courts.

- Article 124C accorded express authority to Parliament to make laws regulating the NJAC’s functioning.

Composition of NJAC

- The Chief Justice of India as the ex officio Chairperson

- Two senior-most Supreme Court Judges as ex officio members

- The Union Minister of Law and Justice as ex officio member

- Two eminent persons from civil society (to be nominated by a committee consisting of the Chief Justice of India, Prime Minster of India and the Leader of Opposition in the Lok Sabha; one of the eminent persons to be nominated from SC/ST/OBC/minorities or women).

Significance:

- The need for the National Judicial Appointment Commission was aroused because many jurists criticised the existing collegium system, stating that India is the only country where judges appoint themselves and have the power of determining their transfers.

Issues with NJAC:

SC’s previous action:

- The concept of NJAC has come under consideration of the Supreme Court three times in 1993, 1998 and 2016.

- All three times, while giving importance to independence of the judiciary, the Supreme Court dismissed the framework of the NJAC.

Issue of political influence:

- It is cited by critics that the judiciary is the only independent institution left in the country.

- It is harmful to allow political influence over it.

- It is also being stated that the collegium system is functioning smoothly.

- There is scope for improvement, but not for any political interference. The central government should in no manner be allowed to control the appointment of the judiciary.

Culture of reciprocity:

- The involvement of the legislature in the appointment of judges might lead to the creation of a culture of ‘reciprocity.’

- Meaning that judges might have the feeling of having to pay back the political executive as a consideration for their appointment to the post of judge

Constitutional impossibility:

- The recent bill was opposed in the Rajya Sabha, calling it a “constitutional impossibility”.

Way Forward:

- There is an urgent need to improve the judge-to-population ratio to reduce the workload of judges.

- Centre had suggested measures like increasing the number of working days of courts, establishment of fast track courts and Indian Courts and Tribunal Services (ICTs) to increase the productivity of the court system.

- Improve judicial infrastructure through the use of e-platforms and setting up of more courts.

- India has launched the e-Courts National portal ecourts.gov.in of the eCourts Project.

Source: The Hindu

Syllabus

- Mains – GS 2 (Governance)

Context: Bhopal has become the first city in India to join the growing global movement on localisation of Sustainable Development Goals (SDGs) following the release of its Voluntary Local Review (VLR).

Voluntary local reviews (VLR):

- The VLR is a subnational review of the progress and challenges in implementing the SDGs at the local level.

- It is a bottom-up and participatory approach that involves multiple stakeholders, such as civil society, the private sector, academia and citizens.

- It aims to enhance accountability, transparency and learning among local actors, as well as to inform and influence national and global policies.

Bhopal’s VLR:

- It is the result of collaboration between the Bhopal Municipal Corporation, UN-Habitat and a collective of over 23 local stakeholders to measurably demonstrate the city’s aspirations for a sustainable and inclusive urban transformation.

- It incorporated a mix of quantitative and qualitative approaches to the review of SDGs, with qualitative mapping of 56 developmental projects.

- It identified key challenges and opportunities for Bhopal to achieve the SDGs, such as urban governance, climate resilience, social inclusion, economic development and innovation.

- It was launched by the Chief Minister of Madhya Pradesh, along with an Agenda for Action: Sustainable Urban Transformation in Bhopal.

- The Agenda for Action outlines a vision and a roadmap for Bhopal to become a smart, green and liveable city by 2030.

- It also proposes concrete actions and initiatives to address the gaps and priorities identified in the VLR.

Significance of VLR:

- As Cities are the most important stakeholders in Agenda 2030, targets could not possibly be achieved without the engagement of local urban stakeholders.

- A VLR is a tool to demonstrate how local actions are leading the way in equitable and sustainable transformations for people and building a coalition of partners towards this endeavour.

- While it is desirable to align a city’s VLR to the State-level action plan and the country’s VNR, the process allows a great deal of flexibility to the cities to tell their story within a framework of their choice.

- It translates the global targets under the 17 SDGs into local indicators at the national level.

- Cities may choose specific SDGs for a detailed review as per their priority and logistical comfort.

- While doing so, they may adapt and further localise the national indicators under the relevant SDGs to reflect the city level realities.

Defining SDGs:

- Sustainable Development Goals (SDGs) are a set of 17 Global Goals that are interlinked and are designed to serve as a blueprint for a future that is sustainable and accessible to all.

- These SDGs were developed by the United Nations General Assembly in the year 2014 and were targeted to be set to be achieved by the year 2030.

- Sustainable Development Goals were included in the General Assembly’s resolution named Agenda 2030.

- The aim of Sustainable Development Goals 2030 is “Transforming the World.”

India’s progress:

- India has made commendable efforts towards the adoption, localisation, and achievement of the SDGs.

- India’s Ministry of Statistics and Program Implementation (MoSPI) has published a National Indicator Framework (NIF) for the review and monitoring of the SDGs.

- It contextualizes the UN’s Global Indicator Framework to represent India’s unique development journey.

- In a NITI Aayog report, at least 23 States and Union Territories have prepared a vision document based on SDGs.

- Almost all of them have initiated steps to localize the SDGs.

Initiatives taken by India to achieve SDG Targets:

- The Mahatma Gandhi National Rural Employment Guarantee Act (MNREGA) is being used to give unskilled workers jobs and raise their standard of living.

- The National Food Security Act is being used to make sure that food grains are subsidised.

- Healthcare sector initiatives which are helpful in achieving sustainable development goals are – The Rashtriya Kishor Swasthya Karyakram, Ayushman Bharat, National digital health mission (NDHM), etc.

- The government of India has taken several steps to mitigate the effects of climate change, like – National Action Plan on Climate Change (NAPCC), National Clean Air Programme (NCAP), National Cyclone Risk Mitigation Project (NCRMP), The Net Zero Commitment.

- The government also supports the 10-Year Framework Programme on Sustainable Consumption and Production.

- For that the Ministry has published a draft notification of regulation on Extended Producer Responsibility (EPR) for Waste Tyre for receiving comments from the public and ‘Guidelines on the EPR for Plastic Packaging’ under Plastic Waste Management Rules, 2016 has been notified.

- Apart from the above-mentioned initiative, other initiatives include the Swachh Bharat mission, Beti Bacho Beti Padhao, Pradhan Mantri Awas Yojana, Smart Cities, Pradhan Mantri Jan Dhan Yojana, Deen Dayal Upadhyay Gram Jyoti Yojana and Pradhan Mantri Ujjwala Yojana, among others.

- JAM trinity: Jan Dhan, Aadhaar and mobile proved to be helpful in forming the Digital Public Goods (DPGs) and Digital Public Infrastructure (DPI) which would be helpful in driving financial inclusion and helping improve benefits targeting which have been crucial to India’s progress on SDG 1, namely No Poverty.

- NITI Aayog “SDG India Index”: It is the world’s first government-led sub-national measure of SDG development.

- It was launched in 2018 and has been developed to capture the progress of all states and union territories (UTs) in their journey towards achieving the SDGs.

Way Forward:

Bhopal’s VLR is a pioneering example of how cities can take ownership and leadership in implementing the SDGs at the local level. It also showcases how cities can collaborate with various partners and stakeholders to leverage their resources and expertise for achieving global goals. Bhopal’s VLR is expected to inspire and motivate other cities in India and beyond to join the global movement of VLRs and contribute to the transformation of our world.

Source: The Hindu

Practice MCQs

Q.1) With reference to Green Deposit, which of the following statements is not correct?

- A green deposit is a fixed-term deposit for investors looking to invest their surplus cash reserves in environmentally friendly projects.

- Sectors such as renewable energy, waste management, clean transportation, energy efficiency, and afforestation are eligible to receive green deposit.

- Banks will be barred from investing green deposits in business projects involving fossil fuels, nuclear power, tobacco, gambling, palm oil and hydropower generation.

- Reserve Bank of India’s Green Deposit framework applies to scheduled commercial banks only.

Q.2) With reference to the Liberalised Remittance Scheme (LRS), consider the following statements:

- LRS allows Indian residents to freely remit up to USD $250,000 per financial year for current or capital account transactions or a combination of both.

- Only individual Indian residents are permitted to remit funds under LRS.

- International credit card spends outside India comes under the Liberalised Remittance Scheme.

Which of the statements given above is/are correct?

- 1 only

- 1 and 3 only

- 3 only

- 1,2 and 3

Q.3) With reference to Kiru Hydro Electric Project, consider the following statements:

- Kiru Hydro Electric Project is proposed on River Jhelum, located in Kishtwar district of the Jammu & Kashmir.

- It is designed complying with the requirements of Indus Water Treaty 1960.

Which of the statements given below is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Comment the answers to the above questions in the comment section below!!

ANSWERS FOR ’ 18th May 2023 – Daily Practice MCQs’ will be updated along with tomorrow’s Daily Current Affairs.st

ANSWERS FOR 17th May – Daily Practice MCQs

Q.1) – b

Q.2) – a

Q.3) – c