Archives

(PRELIMS Focus)

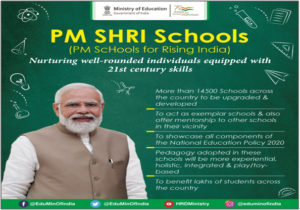

Category: Government Schemes

Context:

- The ruling Left Democratic Front (LDF) appears divided over the Kerala government’s move to sign a MoU with the Union government to access the Prime Minister’s Schools for Raising India (PM SHRI) government school modernisation funds.

About Pradhan Mantri Schools for Rising India (PM-SHRI) Scheme:

- Launch: It is a centrally sponsored initiative, launched in 2022, by the Government of India aimed at establishing over 14,500 PM SHRI Schools by enhancing existing schools to showcase the implementation of the National Education Policy (NEP) 2020.

- Objective: The primary objective is to create an inclusive and nurturing environment that promotes the well-being and safety of every student, offering diverse learning experiences and access to quality infrastructure and resources.

- Funding: The funding pattern is 60:40 between Centre and State Governments and UTs with legislature (except J&K). The sharing pattern is 90:10 for North Eastern and Himalayan States and UT of J&K and 100% central funding for the Union Territories without legislature.

- Need of MoU: States must confirm their participation by signing a Memorandum of Understanding (MoU) with the Education Ministry.

- Duration: The duration of the scheme is from 2022-23 to 2026-27, after which it shall be the responsibility of the states/UTs to continue to maintain the benchmarks achieved by these schools.

- Eligibility:

- Schools managed by Central/State/UT Governments and local bodies.

- All Kendriya Vidyalayas and Navodaya Vidyalayas which are non-project and run from permanent buildings.

- Main features of these schools:

- These schools will focus on holistic student development of students including the skills of communication, collaboration and critical thinking.

- Schools will have modern labs, libraries, art rooms, and promote “green” initiatives like water conservation and waste recycling.

- Learning outcomes will be prioritized, with competency-based assessments that apply knowledge to real-life situations.

Source:

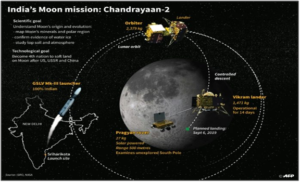

Category: Science and Technology

Context:

- The lunar orbiter of India’s second moon mission, Chandrayaan-2, has made the first-ever observation of the effects of the sun’s coronal mass ejection (CME) on the moon.

About Chandrayaan-2:

- Nature: It is the second lunar exploration mission developed by ISRO after Chandrayaan-1. It is the 1st Indian expedition to attempt a soft landing on moon with indigenous technology.

- Objectives:

- to study lunar topography, mineralogy, elemental abundance, the lunar exosphere, and signatures of hydroxyl and water ice;

- to study the water ice in the south polar region and thickness of the lunar regolith on the surface; and

- to map the lunar surface and help to prepare 3D maps of it.

- Launch vehicle: It was launched using India’s most powerful launcher GSLV MK-III from Satish Dhawan Space Centre in Andhra Pradesh.

- Components:

- There are three components of the mission, a lunar orbiter, the Vikram lunar lander, and the Pragyan rover. The mission’s lander is named Vikram after Dr Vikram A Sarabhai, the Father of the Indian Space Programme.

- The lander, rover and orbiter will perform mineralogical and elemental studies of the lunar surface. The orbiter is deployed at an altitude of 100 kilometers above the surface of the Moon.

- Major payloads:

- Chandrayaan-2 Large Area Soft X-ray Spectrometer (CLASS)

- Solar X-ray Monitor (XSM)

- CHandra’s Atmospheric Compositional Explorer 2 (CHACE 2)

- Dual Frequency Synthetic Aperture Radar (DFSAR)

- Imaging Infra-Red Spectrometer (IIRS)

- Terrain Mapping Camera (TMC 2)

- Orbiter High Resolution Camera (OHRC)

- Dual Frequency Radio Science (DFRS) Experiment

- Step towards PLANEX: The mission is an important step in India’s plans for planetary exploration, a program known as Planetary Science and Exploration (PLANEX).

Source:

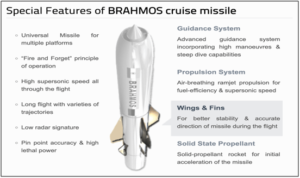

Category: Defence and Security

Context:

- Defence Minister Rajnath Singh said that the BrahMos missiles were a symbol of India’s growing indigenous strength in defence manufacturing and every inch of Pakistan was within their reach.

About BrahMos Missile:

- Nomenclature: It is named after the Brahmaputra River of India and the Moskva River of Russia.

- Range: An Indo-Russian joint venture, the standard BrahMos missile has a range of 290 km and but extended-range versions can reach up to 500 km. Future variants like the BrahMos-II are planned to have a much longer range of up to 1,500 km.

- Fastest cruise missile: It is the world’s fastest cruise missile with a top speed of Mach 2.8 (about three times the speed of sound).

- Two-stage missile; It is a two-stage (solid propellant engine in the first stage and liquid ramjet in the second) missile. The solid propellant booster engine propels it to supersonic speed before separating, and during the cruise phase, the liquid ramjet or second stage, propels the missile closer to 3 Mach.

- Launch platforms: It is a multiplatform missile which can be launched with great accuracy from land, air and sea having multi-capability capabilities and can operate during day and night despite bad weather.

- Uniqueness: It operates on the “fire and forget” principle i.e. it does not require guidance after launch. It also carries a conventional warhead weighing 200 to 300 kg.

- Propulsion and Flight: Jet engines are the primary mode of propulsion for cruise missiles. Most cruise missiles are subsonic and use Turbofan and Turbojet engines. While less common, supersonic and hypersonic cruise missiles utilize Ramjet and Scramjet engines.

Source:

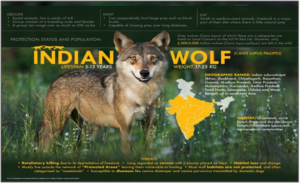

Category: Environment and Ecology

Context:

- A discreet, charismatic denizen of scrubland and grasslands, the Indian wolf (Canis lupus pallipes) is likely to be classified as a new species by the IUCN.

About Indian wolf:

- Nature: The Indian wolf is one of the most ancient and genetically unique wolf lineages in the world, endemic to the Indian subcontinent.

- Scientific Name: Canis lupus pallipes, commonly referred to as the Peninsular wolf or Indian grey wolf.

- Uniqueness: Fossil and genetic studies show that it diverged from other wolf species thousands of years ago, making it one of the oldest wolf lineages in the world.

- Conservation status:

- It is classified as ‘Vulnerable’ by the International Union for Conservation of Nature (IUCN).

- It is placed under ‘Schedule 1’ of the Wildlife Protection Act.

- Distribution: The Indian wolf was historically found across northern and western India, from Punjab and Haryana to Rajasthan and Maharashtra, thriving in open plains and semi-arid regions.

- Drastic reduction in population: Due to habitat loss, persecution, and expanding agriculture, the species has now vanished from many areas, including parts of Punjab, Haryana, and Himachal Pradesh. Its population has dwindled to just around 3,000 individuals in India and Pakistan.

- Best models for co-existence: The wolf, like the bustards and other denizens of the open natural ecosystems, do not need strict protected areas. Rather they serve as the best models for co-existence, and this is what needs to be incentivised.

Source:

Category: Polity and Governance

Context:

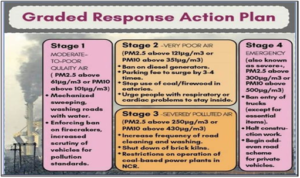

- Chief Minister of Delhi appealed to residents to celebrate Deepavali by bursting only certified green crackers as the Capital’s air quality index (AQI) crossed 300, prompting the enforcement of stage II of the Graded Response Action Plan (GRAP).

About Graded Response Action Plan (GRAP):

- Nature: GRAP is a set of emergency measures that kick in to prevent further deterioration of air quality once it reaches a certain threshold in the Delhi-NCR region.

- Judgement: It was approved by the Supreme Court in 2016 after the Supreme Court’s order in the matter of M. C. Mehta vs. Union of India (2016) and notified in 2017.

- Implementation: The Commission for Air Quality Management (CAQM) in NCR and adjoining areas oversees the implementation of GRAP. It collaborates with the Ministry of Environment, Forest and Climate Change (MoEFCC).

- Evolution:

- Till 2020, the Supreme Court-appointed Environment Pollution (Prevention & Control) Authority (EPCA) used to order States to implement GRAP measures.

- The EPCA was dissolved and replaced by the Commission for Air Quality Management (CAQM) in 2020.

- From 2021 onwards, the GRAP is being implemented by the CAQM.

- Role of IITM and IMD: CAQM relies on air quality and meteorological forecasts by the Indian Institute of Tropical Meteorology (IITM) and the India Meteorological Department (IMD).

- Various stages of GRAP:

- Stage I (Poor Air Quality – AQI 201-300): Enforce NGT / Hon’ble SC’s order on over aged diesel / petrol vehicles.

- Stage II (Very Poor- AQI 301-400): Targeted actions to combat air pollution at identified hotspots in the region. Regulated operations of DG (Diesel Generators) have been set across all sectors in the NCR.

- Stage III (‘Severe’- AQI 401-450): Impose strict restrictions on BS III petrol and BS IV diesel four-wheelers in certain areas and may suspend physical classes in schools for primary grade children up to Class 5.

- Stage IV (Severe Plus- AQI greater than 450): When the AQI exceeds 450, four-wheelers registered outside Delhi, except for electric vehicles, CNG vehicles, and BS-VI diesel vehicles and vehicle carrying essential commodity, will not be allowed to enter the city.

Source:

(MAINS Focus)

(Relevant to UPSC GS Paper II – Bilateral, Regional and Global Groupings and Agreements Involving India

and/or Affecting India’s Interests)

Context (introduction)

India’s Defence Minister’s 2025 visit to Australia marked a new milestone in bilateral defence ties, with operational and industrial agreements that transformed the partnership from strategic convergence to practical interoperability across the Indo-Pacific maritime domain.

Main Arguments

- From Strategic Convergence to Operational Cooperation

- The inaugural India–Australia Defence Ministers’ Dialogue produced agreements such as the Joint Maritime Security Collaboration Roadmap and renewal of the Defence and Security Cooperation Declaration.

- Establishment of Joint Staff Talks, submarine-rescue cooperation, and air-to-air refuelling arrangementsstrengthened interoperability and tactical coordination.

- The partnership now enables contingency planning, joint exercises, and information-sharing across air and maritime domains.

- Evolving Phases of Defence Partnership

- Phase I – Strategic Convergence: Shared Indo-Pacific vision through the Quad and concerns over China’s assertiveness.

- Phase II – Operational Deepening: Joint exercises (e.g., Talisman Sabre), logistics talks, and intelligence sharing.

- Phase III – Industrial Convergence: Emerging cooperation in maintenance, repair, and supply-chain security, signalling a shift from dialogue to sustained collaboration.

- Structural and Pragmatic Drivers

- Structural: Shifting maritime balance and Beijing’s coercive behaviour push middle powers to enhance redundancy and reduce vulnerability.

- Pragmatic: Uncertainties over traditional security providers have motivated both countries to develop bilateral crisis-response mechanisms and industrial resilience.

- AUKUS dynamics and Australia’s access to advanced systems offer India opportunities for technological and operational synergy.

- Complementary Strengths and Industrial Synergy

- India: Large-scale defence manufacturing (₹1.5 lakh crore output in FY 2024–25), cost efficiency, and maritime geography near key sea lanes.

- Australia: Advanced undersea systems (P-8A, Triton drones, “Ghost Shark”), robust R&D, and innovation networks.

- The collaboration merges India’s scale and affordability with Australia’s high-tech edge, enabling co-development and joint sustainment of regional security capabilities.

- Political and Institutional Significance

- Elevated from Strategic Partnership (2009) to Comprehensive Strategic Partnership (2020), the relationship is underpinned by shared democratic values and economic interdependence.

- Regularised dialogues and annual ministerial meetings ensure institutional continuity beyond political cycles.

- Strengthened defence cooperation aligns with Quad objectives and reinforces India’s leadership in the southern Indo-Pacific.

Criticisms and Challenges

- Limited binding commitments: The cooperation remains incremental and reversible, lacking formal defence guarantees.

- Information-sharing sensitivities: Classified data exchange frameworks are still developing.

- Dependence on external alliances: Australia’s strong AUKUS commitments may complicate independent Indo-Indian cooperation.

- Implementation lag: Bureaucratic and logistical hurdles could delay operationalisation of ship-repair and logistics support agreements.

- Geopolitical balancing: Both nations must avoid being drawn into great-power blocs while safeguarding regional autonomy.

Future Path

- Institutionalisation: Deepen joint staff mechanisms and standard operating procedures for humanitarian assistance and maritime surveillance.

- Defence Industry Integration: Promote co-production and joint R&D under iDEX and Defence Production Corridors.

- Quad Synergy: Align bilateral outcomes with Quad’s Maritime Domain Awareness Initiative.

- People-to-People & Education Linkages: Foster defence education exchanges, naval academies’ cooperation, and private-sector participation.

- Sustainable Security Architecture: Develop a shared logistics and repair ecosystem across Indian and Australian shipyards to reduce dependence on extra-regional powers.

Conclusion

India–Australia defence cooperation is evolving from symbolic partnership to functional interoperability. Anchored in trust, shared maritime interests, and industrial complementarity, it promises to shape a stable, resilient, and inclusive Indo-Pacific security order.

Mains Question:

- India–Australia defence relations are increasingly shifting from symbolic convergence to operational and industrial cooperation. Analyse how this transformation contributes to stability and self-reliance in the Indo-Pacific. (250 words, 15 marks)

Source: The Hindu

(Relevant to UPSC GS Paper III – Indian Economy and Issues Relating to Planning, Mobilization of Resources, Growth, Development and Employment)

Context (Introduction)

Despite robust GDP growth and major policy incentives — from corporate tax cuts to infrastructure push — private sector investment in India remains sluggish, forcing the government to continue as the main driver of capital formation and growth.

Main Arguments

- Nature of the Problem – Weak Private Investment

- India’s Gross Fixed Capital Formation (GFCF), representing all investments in fixed assets, has been declining since 2011–12, staying below 30% of GDP for most years after 2014.

- Within GFCF, the private corporate sector’s share has steadily fallen, especially post-2019, despite major corporate tax cuts.

- In FY24, while nominal GDP grew by 12%, private and household investment shares dropped, with only government spending rising — indicating an imbalanced investment recovery.

- Policy Efforts to Revive Investment

- The government aimed to trigger a self-sustaining growth cycle by boosting consumption demand (through income-tax reliefs, GST rate cuts, and direct transfers).

- Large-scale public infrastructure investment — roads, ports, logistics, and railways — was meant to “crowd in” private investment.

- Structural reforms like the corporate tax cut (2019), PLI schemes, and ease of doing business initiatives sought to enhance private sector confidence and profitability.

- Why Private Investment Matters

- Sustained private capital formation is vital for long-term growth, job creation, and innovation.

- When private firms expand capacity and production, it creates a virtuous cycle of employment, income, and demand, reducing reliance on state expenditure.

- Without it, growth becomes fiscally driven, straining public finances and limiting the scope for social and welfare spending.

- Structural Reasons for Weak Investment Response

- Demand uncertainty: Despite recovery in consumption, uneven income distribution and inflation have restrained durable goods demand.

- Excess capacity: Many sectors, especially manufacturing, still operate below full capacity post-pandemic.

- Corporate deleveraging: Firms are using profits to reduce debt rather than expand operations.

- Global headwinds: Slowing export demand and geopolitical uncertainties affect investment confidence.

- Implementation gaps: Delays in PLI disbursals and complex compliance environments reduce private participation in industrial schemes.

- Implications for India’s Growth Strategy

- The state-led investment model is increasingly driving growth, contrary to the “Minimum Government, Maximum Governance” vision.

- Private sector reticence undermines employment generation, worsens inequality, and limits innovation-led growth.

- The imbalance could make India’s high growth unsustainable, as government capital expenditure cannot indefinitely substitute for private enterprise dynamism.

Criticisms and Drawbacks

- Policy fatigue: Repeated fiscal stimuli and tax incentives have not translated into higher private capex.

- Inequality trap: Consumption growth driven by upper-income segments limits broad-based demand recovery.

- Dependence on government spending: Raises fiscal deficit and debt concerns.

- Limited credit uptake: Despite high liquidity, credit flow to private industry remains sluggish.

- Weak business sentiment: Regulatory unpredictability and slow contract enforcement deter risk-taking.

Reforms and the Way Forward

- Boosting Demand Confidence: Broaden income growth through rural consumption support, MSME revival, and job-intensive sectors.

- Predictable Policy Framework: Ensure regulatory stability and faster dispute resolution to improve investment climate.

- Strengthening PLI and Industrial Corridors: Streamline procedures, decentralise approvals, and focus on value-chain linkages.

- Credit and Financing Ecosystem: Expand development finance institutions (DFIs) and bond market depth to fund private projects.

- Public–Private Partnerships: Revitalise PPP models with risk-sharing mechanisms to catalyse infrastructure and green investments.

Conclusion

India’s growth cannot rely indefinitely on state-led investments. Reviving private sector confidence through stable demand, transparent policies, and innovation incentives is essential for a sustainable, employment-rich, and self-propelling economic trajectory.

Mains Question:

- Despite policy reforms and incentives, private sector investment in India remains subdued. Analyse the structural and policy factors behind this trend and suggest measures to restore private investment dynamism. (250 words, 15 marks)

Source: The Indian express