Archives

(PRELIMS Focus)

Category: Geography

Context:

- Recently, the Border Roads Organisation (BRO) successfully carried out a high-altitude rescue and road restoration operation under Project Sampark at Chatergala Pass.

About Chattergala Pass:

- Location: It falls on the boundary of the Doda and Kathua districts in Jammu region of Union Territory of Jammu and Kashmir.

- Connectivity: It connects Bhaderwah (Neeru river valley) in Doda district with Basohli (Shiwalik hills) in Kathua district.

- Mountain range: It is situated at an elevation of approximately 10,500 feet in the Middle Himalayas. It is tucked in the Chamba-doda ranges of the greater Himalayas.

- Terrain: It is surrounded by alpine meadows, snow-covered peaks, and dense forest.

- Fauna: Himalayan monals, ibex, and musk deer are found here.

- Strategic significance: The pass is critical for border security and regional connectivity, often used by the Border Roads Organisation (BRO) to ensure the movement of troops and supplies.

- Gateway: It serves as a gateway between the Jammu and Kashmir divisions, specifically bypassing the traditional NH-44 route.

- Chattergala Tunnel Project: To overcome the challenges of heavy snowfall (which can reach up to 5-6 feet in winters), the government is constructing a tunnel beneath the pass. It is a 6.8 km long road tunnel, which will be constructed at an estimated cost of Rs. 4,000 crore.

Source:

Category: Miscellaneous

Context:

- Recently, the President of India has conferred the Jeevan Raksha Padak Series of Awards-2025 to 30 persons.

About Jeevan Raksha Padak Awards:

-

- Nature: The Jeevan Raksha Padak awards are a series of civilian life-saving honours presented by the Government of India for meritorious acts of courage in saving a person’s life.

- Establishment: Originally instituted in 1961 as an offshoot of the Ashoka Chakra series, these awards are traditionally announced on Republic Day.

- Categories: The Jeevan Raksha Padak Award is given in three categories, namely,

- Sarvottam Jeevan Raksha Padak: It is awarded for conspicuous courage in saving life under circumstances of very great danger to the life of the rescuer.

- Uttam Jeevan Raksha Padam: It is awarded for courage and promptitude in saving life under circumstances of great danger to the life of the rescuer.

- Jeevan Raksha Padak: It is awarded for courage and promptitude in saving life under circumstances of grave bodily injury to the rescuer.

- Eligibility: Persons of all walks of life are eligible for these awards. The award can also be conferred posthumously.

- Presentation: It is presented to the awardees by the respective Union Ministries/Organizations/State Government to which the awardee belongs.

- Nomination and approval: Its nominations are invited annually from States/UTs and Union Ministries. The recommendations of the award are considered by the Awards Committee within a period of two calendar years from the date of performance of the act. Final approval is given by the Prime Minister and the President of India.

- Award: The decoration of the award consists of a Medal, Certificate, along with a one-time monetary allowance: Sarvottam Jeevan Raksha Padak (₹2 lakh), Uttam Jeevan Raksha Padam (₹1.5 lakh) and Jeevan Raksha (₹1 lakh).

Source:

Category: Science and Technology

Context:

- Recently, Kerala officially declared Bacillus subtilis as ‘State microbe’.

About Bacillus Subtilis:

-

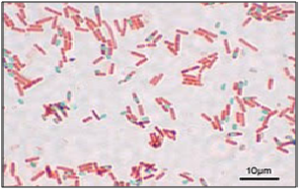

- Classification: It is a rod-shaped, Gram-positive bacterium.

- Metabolism: It is a facultative anaerobe, meaning it can grow in both oxygen-rich and oxygen-poor environments.

-

- Nature: Bacillus subtilis (B. subtilis) is a type of probiotic (“good” bacteria) found naturally in the human gut. It’s also found in fermented foods.

- Habitat: It is mostly found in soil and vegetation with an optimal growth temperature from 25-35 degrees Celsius.

- Significance: B. subtilis has the ability to produce and secrete antibiotics. The genomic structure of this microorganism contains five signal peptidase genes that are important for the secretion of these antibiotics. It has shown to be capable of secreting polymyxin, difficidin, subtilin, and mycobacillin.

-

- Resilience: A major feature is its ability to form tough, protective endospores. These allow it to survive extreme conditions like heat, UV radiation, and drought for decades.

- Transmission and disease: B.subtilis is non-pathogenic but can contaminate food and be considered an opportunistic pathogen among the immuno-compromised.

- Applications:

-

- Agriculture (Bio-control): It is widely used as a bio-fungicide (e.g., the product ENTAZIA) to protect crops from diseases like Bacterial Leaf Blight by colonising root systems and producing antibiotics.

- Probiotics: It supports gut health and immunity in humans and animals. It is even used to enhance performance in poultry.

- Fermentation: It is essential for traditional fermented foods like Natto (Japan), Kinema (Sikkim), and Akhuni (Nagaland).

- Biotechnology: It is used on an industrial scale to produce enzymes like amylases and proteases, as well as vitamins.

- Environmental utility: It plays a role in bioremediation by cleaning heavy metals and hydrocarbons from contaminated sites and can even be used to degrade certain plastics.

Source:

Category: Environment and Ecology

Context:

- India’s pygmy hog is vanishing from its grasslands, just as it is needed the most.

About Pygmy Hog:

-

- Scientific Name: Its scientific name is Porcula salvania (It is the sole member of its genus).

- Uniqueness: It is the smallest and rarest species of wild pig in the world. It is one of the very few mammals that build its own home, or nest, complete with a ‘roof’.

-

- Endemic: It is currently found only in Assam, India. Its primary strongholds are grasslands of Manas National Park and Orang National Park.

- Reintroduction: Captive-bred hogs have been successfully reintroduced into Sonai-Rupai Wildlife Sanctuary and Barnadi Wildlife Sanctuary

- Significance: It is an indicator species as its presence reflects the health of its primary habitat. Its presence reflects the health of the Terai-Duar ecosystem.

-

- Habitat: It prefers undisturbed patches of grassland dominated by early succession riverine communities, typically comprising dense tall grass intermixed with a wide variety of herbs, shrubs and young trees.

- Ecological role: Using its snout, it digs for roots, tubers, wild fruits, termites, earthworms, eggs and other food sources found in the grasslands. This digging aerates the soil and enhances its quality. It also helps disperse seeds through its dietary and foraging habits.

- Conservation Status:

-

- IUCN: Critically Endangered

- The Wildlife Protection Act, 1972: Schedule I.

Source:

Category: International Organisations

Context:

- Boosting maritime engagement with Indonesia and advancing the vision of MAHASAGAR, Indian Navy’s First Training Squadron departed Belawan recently.

About Indian Ocean Naval Symposium (IONS):

-

- Nature: It is a voluntary initiative that seeks to increase maritime cooperation among navies of the littoral states of the Indian Ocean Region by providing an open and inclusive forum for discussion of regionally relevant maritime issues.

- Origin: It was conceived by the Indian Navy in 2008. The inaugural edition of IONS was held in Feb 2008 at New Delhi, with the Indian Navy as the Chair for two years (2008–2010).

- Objective: It endeavours to generate a flow of information between naval professionals that would lead to common understanding and possibly cooperative solutions on the way ahead.

- Significance: It promotes maritime cooperation, mutual understanding, and collaboration on issues such as maritime security and humanitarian assistance and disaster relief (HADR).

- Governance: IONS is structured around a rotating chairmanship, biennial conclaves of chiefs, and working groups.

-

- Membership: It includes 34 members (25 full members and 9 observers) from Indian Ocean littoral states. The full members are:

- South Asian Littorals: Bangladesh, India, Maldives, Pakistan, Seychelles, Sri Lanka.

- West Asian Littorals: Iran, Oman, Saudi Arabia, United Arab Emirates (UAE).

- East African Littorals: Kenya, Mauritius, Mozambique, South Africa, Tanzania, Eritrea.

- Southeast Asian & Australian Littorals: Australia, France (via Reunion), Indonesia, Malaysia, Myanmar, Singapore, Thailand, Timor-Leste.

- Other: United Kingdom (British Indian Ocean Territory).

- Membership: It includes 34 members (25 full members and 9 observers) from Indian Ocean littoral states. The full members are:

- Focus areas:

-

- Maritime cooperation: Enhancing naval collaboration for regional security.

- Information sharing: Exchanging best practices on maritime issues.

- Disaster response: Developing effective mechanisms for Humanitarian Assistance & Disaster Relief (HADR).

Source:

(MAINS Focus)

GS-II: India and its relations with other countries; international institutions, global groupings and agreements involving India and/or affecting India’s interests.

Context (Introduction)

India has witnessed a sharp depreciation of the rupee since April 2025 (~6%), despite strong macroeconomic fundamentals

- GDP growth ~7.4%

- CPI inflation at 3.33% (below RBI lower tolerance band)

- Current Account Deficit at just 0.76% of GDP (H1 2025–26)

This disconnect suggests that the rupee’s fall is not primarily economic, but geopolitical and diplomatic in origin.

Core Idea

The recent rupee depreciation is driven less by trade fundamentals and more by geopolitically induced capital outflows, especially due to U.S. tariff actions and strategic uncertainty. Hence, diplomacy not devaluation or monetary intervention—is the primary solution. The exchange rate problem has shifted from economics to geopolitics.

Key Drivers of Rupee Weakness

- Capital Outflows (Primary Villain)

- Net capital inflows fell from +$10.6 bn (Apr–Dec 2024) to –$3.9 bn (Apr–Dec 2025)

- Triggered by:

- 50% U.S. import tariffs on Indian exports

- Threat of secondary sanctions linked to India’s oil trade with Russia and Iran

- Capital outflows accelerate as rupee weakens, creating a self-reinforcing cycle

- Weaponisation of Trade & Tariffs

- U.S. trade actions driven by strategic hostility, not macro fundamentals

- Tariffs used as geopolitical instruments, shifting resolution from WTO/economic forums to bilateral diplomacy

- Limits of RBI Intervention

- Since 1993, India follows a market-determined exchange rate

- RBI intervenes only to reduce volatility, not to defend a level

- Intervention:

- Can smooth sudden shocks

- Cannot counter persistent geopolitical capital exits

Why Devaluation Is Not the Remedy

Export Gains Are Limited

- High U.S. tariffs negate competitiveness gains

- India’s export basket increasingly value-added, not price-sensitive

Inflation Risks Are High

- Crude oil = ~25% of total merchandise imports

- Rupee fall → higher import costs → imported inflation

REER, Not Nominal Rate, Matters

- Devaluation helps only when inflation differential is large, which is not the case for India

- Focus must be on Real Effective Exchange Rate (REER), not nominal depreciation

Why This Matters

- Macroeconomic stability cannot offset geopolitical shocks

- Currency stability is now linked to foreign policy credibility

- Prolonged rupee weakness can:

- Undermine investor confidence

- Depress equity markets (via FPI exits)

- Complicate inflation management

This marks a shift from globalisation-driven economics to geopolitics-driven markets.

Way Forward

- Diplomatic Resolution with the U.S. (Priority)

- Early conclusion of trade negotiations

- De-escalation of tariff and sanctions uncertainty

- Strategic Economic Diplomacy

- Reduce overexposure to single markets

- Strengthen ties with EU, ASEAN, Middle East

- RBI’s Role: Calibrated, Not Aggressive

- Continue volatility management, not rate defence

- Clear communication to anchor market expectations

- Capital Flow Resilience

- Improve real returns to attract long-term investors

- Policy certainty over fiscal, taxation, and regulation

Conclusion

The rupee’s recent fall is not a verdict on India’s economic fundamentals, but a reflection of geopolitical stress transmitted through capital markets. In an era where tariffs and finance are tools of strategic contestation, currency stability requires diplomatic solutions, not devaluation.

When geopolitics drives markets, diplomacy becomes macroeconomic policy.

Mains Question

In an era where trade policy, sanctions, and capital flows are increasingly shaped by geopolitical contestation, exchange-rate movements can no longer be analysed purely through macroeconomic fundamentals. Critically examine. (250 words)

GS-II: “India and its relations with other countries; effect of policies and politics of developed and developing countries on India’s interests.”

GS-III: “Indian Economy and issues relating to planning, mobilisation of resources, growth, development and employment.”

Context (Introduction)

India–EU relations have entered a phase of strategic convergence amid a turbulent global order marked by U.S. unpredictability, China’s assertiveness, supply-chain shocks, and fragmentation of multilateralism.

The January 2026 visit of the EU’s top leadership to Delhi signalled political momentum, but the real test lies in translating breakthroughs into delivery—especially in trade, technology, defence cooperation, and economic resilience.

Core Idea

India–EU relations have matured politically, but now face a delivery deficit. While strategic intent is aligned, outcomes depend on institutional capacity, economic reforms, regulatory coordination, and sustained bureaucratic follow-through, not summit diplomacy alone.

India must move from episodic engagement to deep, operational partnerships, while the EU must treat India as a strategic equal, not merely a market or values partner.

Key Areas of Convergence

- Trade and Economic Integration

- Revival of the India–EU Free Trade Agreement (FTA) after years of stagnation.

- EU is already India’s second-largest trade partner after China.

- FTA aims at:

- Supply chain diversification

- Resilient value chains

- Reduced over-dependence on China

- Shift from tariff-centric trade to standards, data rules, sustainability norms.

- Technology and Strategic Autonomy

- Cooperation in artificial intelligence, semiconductors, green hydrogen, advanced manufacturing.

- Objective: Prevent a global technology duopoly.

- Technology is not just economic power but norm-setting power.

- Defence and Security Cooperation

- Expansion of cooperation in:

- Western Indian Ocean

- Maritime domain awareness

- Defence industrial collaboration

- Europe emerging as an advanced defence partner, not just arms supplier.

- Geopolitical Alignment

- Shared concerns on:

- Russia–Ukraine war

- China’s rise

- Global South instability

- EU seeks reduced dependence on U.S. security umbrella.

- India seeks multipolar partnerships without alliance entanglements.

Structural and Institutional Challenges

- Delivery Deficit

- Agreements stall at:

- Regulatory approvals

- Bureaucratic coordination

- Centre–State alignment in India

- Trade liberalisation requires years of administrative mobilisation, not just political consensus.

- Asymmetry in Expectations

- EU emphasises:

- Sustainability standards

- Labour and climate conditionalities

- India prioritises:

- Growth

- Manufacturing

- Developmental flexibility

- Fragmented European Landscape

- EU is multilingual, multinational, requiring:

- Engagement beyond Brussels

- Outreach to Germany, France, Nordics, Central & Eastern Europe

Why This Matters for India

- India’s $10 trillion economy goal by 2030s depends on:

- Stable export markets

- Capital inflows

- Technology access

- EU partnership supports:

- Manufacturing upgrade

- Green transition

- Skill mobility

- Reduces vulnerability to:

- U.S. trade weaponisation

- China-centric supply chains

Way Forward

- Move from Summits to Systems

- Empower joint secretariats

- Time-bound implementation roadmaps

- Deepen Sub-regional Engagement

- Nordics (green tech)

- Germany (manufacturing, defence)

- France (strategic and nuclear cooperation)

- Regulatory Readiness in India

- Align domestic standards with global benchmarks

- Strengthen institutional capacity at State level

- Link FTA with Industrial Policy

- Use FTA to integrate India into EU value chains

- Complement with PLI schemes and skilling

- Sustain Political Attention

- High-level engagement beyond symbolism

- Continuous bureaucratic ownership

Conclusion

India–EU relations have reached a strategic inflection point. The challenge is no longer vision, but execution.

If Delhi and Brussels succeed in converting political alignment into economic and technological delivery, the partnership can become a pillar of a new multipolar order. Failure, however, would relegate it to yet another high-potential but under-performing strategic relationship.

In a fractured world, partnerships that deliver rather than merely declare will shape the future order.

Mains Question

- “India–EU relations have reached a strategic convergence, but the real challenge lies in translating political breakthroughs into economic and technological delivery.” Critically examine (250 words, 15 marks)