Archives

(PRELIMS Focus)

Category: Economy

Context:

- Hinting at a possible shift in India’s cryptocurrency policy, Union Finance Minister said countries would have to “prepare to engage” with stablecoins whether they welcome the change or not.

About Stablecoins:

- Nature: Stablecoins are a type of cryptocurrency that attempt to maintain stable prices as they are pegged to an underlying asset, such as a basket of currencies or precious metals like gold.

- Terminology: Although the term “stablecoin” is commonly used, there is no guarantee that the asset will maintain a stable value in relation to the value of the reference asset when traded on secondary markets or that the reserve of assets, if there is one, will be adequate to satisfy all redemptions.

- Difference with cryptocurrencies:

- Stablecoins are designed for everyday use, offering price stability unlike volatile cryptocurrencies like Bitcoin.

- They enable easy value transfer, support financial services, and maintain stability through collateral reserves or algorithmic supply control.

- Popular stablecoins like Tether and USD Coin are backed by the US dollar.

- Types of Stablecoins: There are primarily three types of stablecoins: fiat-collateralized, crypto-collateralized, and non-collateralized (algorithmic).

- Fiat-collateralized stablecoins are pegged to a specific asset, such as a fiat currency. The entity behind the stablecoin maintains a reserve of the asset or assets backing the stablecoin, supporting the value of the digital currency.

- On the other hand, non-collateralized (algorithmic) stablecoins use software algorithms to automatically adjust the supply of the stablecoin based on demand, aiming to maintain a stable price.

- Status of stablecoins in India:

- India does not currently recognise stablecoins, treating all cryptocurrencies as Virtual Digital Assets (VDAs) under Section 2(47A) of the Income Tax Act, 1961.

- In 2023, VDAs were brought under the Prevention of Money Laundering Act, 2002, to curb misuse and enhance oversight.

- Central Bank Digital Currency (CBDC) or ‘Digital Rupee’ is India’s official alternative to stablecoins, which allows programmable payments (e.g., Direct Benefit Transfer (DBT) schemes), tracking usage by expiry, location, or purpose.

Source:

Category: History & Culture

Context:

- Two people were killed and more than a hundred were injured at the annual Banni festival at Devaragattu in Kurnool district of Andhra Pradesh.

About Banni Festival:

- Nature: It is a tradition in Andhra Pradesh where villagers fight with sticks to claim a deity’s idol on Vijayadashami. The objective of this event is to snatch the idols from the God’s team, leading to a fierce battle known as the Banni Fight.

- Occasion: It is celebrated on the night of Dussehra celebration (Vijaya Dasami) every year.

- Location: It is held on the premises of Mala Malleswara Swamy Temple (situated at the border of Andhra Pradesh and Karnataka).

- Linkage with Vijayanagara Empire: This festival was celebrated by people under the Vijayanagara Empire.

- Significance: It is celebrated on the account of the victory of Lord Mala Malleswara Swamy and Goddess Parvati over demonish Mani and Mallasura, who troubled the people at Devaragattu region.

- Rituals:

- The ritual takes place at midnight when the procession of idols of the ruling deities Malamma (Parvati) and Malleshwara Swamy (Shiva) are brought down the hill temple at Neraneki.

- Devotees carry long sticks or lathis with them for hitting each other with these sticks on the head. The basic idea of this fight is to capture the procession idol.

Source:

Category: Economy

Context:

- The government think tank Niti Aayog suggested the introduction of a presumptive taxation scheme for foreign companies to provide certainty and simplicity.

About Presumptive Taxation:

- Nature: It is a simplified tax scheme where income is calculated based on a presumed rate of profit rather than actual income.

- Need: Despite India’s inherent appeal and remarkable FDI growth, structural impediments such as ambiguous PE (permanent establishment), regulations introduce tax uncertainty and dampen investments.

- Objectives:

- To provide relief to taxpayers from the tedious work of maintaining regular books of account under certain circumstances.

- To provide tax certainty and reduce compliance burdens.

- To align with India’s goal of becoming a global manufacturing hub under initiatives like Make in India.

- Importance:

- The optional presumptive taxation scheme would help resolve disputes concerning PE (permanent establishment), simplifying compliance and protecting revenue.

- By adopting a presumptive taxation scheme, India can transform its tax regime from a ‘minefield’ into a ‘well-lit path.’

- Impact on businesses: A company opting for this scheme can declare income at a prescribed rate; in lieu of that, it is relieved from maintaining books of accounts for audit by tax authorities.

Source:

Category: International Relations

- Context:

- A quarter of a century after it joined NATO, Poland will finally join the alliance‘s fuel pipeline network, amid rising tension on its eastern frontier.

About NATO:

-

- Nature: The North Atlantic Treaty Organization (NATO) is an intergovernmental military alliance.

- Formation: It was established on April 4, 1949, with the signing of the North Atlantic Treaty in Washington, D.C. by 12 founding member countries from Europe and North America.

- Objective: It was established with the primary goal of providing collective defence against potential aggression, particularly from the Soviet Union during the Cold War era. Over the years, NATO has evolved to address a range of security challenges beyond its original mandate.

- Uniqueness: NATO’s primary mission is collective defence, as outlined in Article 5 of the North Atlantic Treaty. This article stipulates that an attack on one member country will be considered an attack on all, and the members will respond collectively.

- Founding members: The original 12 founding members of NATO were Belgium, Canada, Denmark, France, Iceland, Italy, Luxembourg, the Netherlands, Norway, Portugal, the United Kingdom, and the United States.

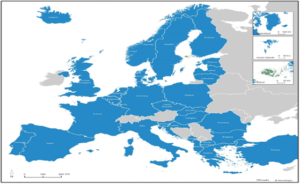

- Expansion: NATO has expanded since its founding, with new member countries joining in multiple rounds. The alliance currently consists of 32 member countries.

- Political Leadership: The North Atlantic Council (NAC) serves as NATO’s principal political decision-making body, composed of ambassadors from all member countries.

- Funding: In 2006, NATO Defense Ministers agreed to a commitment that 2% of their countries’ GDP would be allocated towards defence spending. However, the majority of NATO members do not meet this goal. Currently, the US accounts for over 2/3rd of the alliance’s defence spending.

Source:

Category: Miscellaneous

Context:

- Millions of people in Somalia face worsening hunger as major cuts to donor aid leave the World Food Programme with a critical funding shortfall, the UN agency warned.

About World Food Programme:

- Establishment: It is the world’s largest humanitarian agency and was established in 1961.

- Associated with UN: It is a branch of the United Nations that deals with hunger eradication and promotes food security in the world.

- SDG 2: The organization’s work is guided by Sustainable Development Goal 2, which aims to end hunger, achieve food security and improved nutrition, and promote sustainable agriculture by 2030.

- Extent: It operates in more than 120 countries, provides food assistance during emergencies and works with communities to enhance nutrition and generate resilience.

- Funding: The WFP has no independent source of funds, it is funded entirely by voluntary donations. Its principal donors are governments, but the organization also receives donations from the private sector and individuals.

- Nobel prize: The WFP has been awarded with the Nobel Prize for Peace 2020 for its efforts to combat hunger, bettering conditions for peace in conflict-affected areas and preventing the use of hunger as a weapon of war and conflict.

- Reports by WFP: The report released by the WFP is the Global Report on Food Crisis which describes the scale of acute hunger in the world.

- Headquarters: Its headquarter is located in Rome, Italy.

Source:

(MAINS Focus)

(GS Paper 3: Conservation, Environmental Pollution and Degradation, Environmental Impact Assessment)

Context (Introduction)

India’s rapid clean energy expansion, marked by record solar additions and global leadership in renewables, faces a looming financial challenge. Despite strong progress, achieving climate goals by 2030 requires a dramatic scale-up in climate finance and innovative funding models.

India’s Clean Energy Momentum

- Rapid Growth: India added 24.5 GW of solar capacity in 2024, becoming the third-largest contributor globally after China and the US.

- Employment and GDP: The renewable sector employs over one million workers, contributing 5% to GDP growth; off-grid solar alone supports 80,000 jobs.

- Global Recognition: The UN Secretary-General’s 2025 Climate Report identifies India as a leader in scaling solar and wind.

- Institutional Leadership: Initiatives like the International Solar Alliance (ISA) and sovereign green bondsshowcase India’s proactive global and domestic role.

- Economic Promise: As per IRENA, a 1.5°C-aligned pathway could yield 2.8% annual GDP growth till 2050, surpassing the G-20 average.

Critical Gaps – The Climate Finance Deficit

- Financing Need: India requires $1.5–2.5 trillion in climate finance by 2030 to meet its NDCs and 1.5°C goals.

- Current Flow: Despite a 186% rise in GSS+ debt issuance since 2021, total aligned issuance of $55.9 billion remains insufficient.

- Private Sector Dominance: 84% of green bonds come from large corporates; MSMEs, agri-tech innovators, and local infrastructure developers face funding barriers.

- Limited Concessional Finance: De-risking instruments and blended finance mechanisms remain underutilised.

- Regional Disparities: Tier-II and III cities lack investor confidence due to governance and delivery risks.

Reforms and Strategic Shifts

- Blended Finance Expansion: Use of partial guarantees, subordinated debt, and performance guarantees can improve risk-return ratios and attract private investors.

- Public Finance Leverage: Governments can integrate green budget tagging, fiscal incentives, and de-risking measures to mobilise private capital.

- Institutional Capital Mobilisation: Pension funds and insurers like EPFO and LIC should allocate portfolios to climate-aligned assets through ESG regulatory reforms.

- Carbon Markets: The Carbon Credit Trading Scheme (CCTS) can become a major finance source if made transparent, equitable, and regulated.

- Technology Integration: Adoption of AI for risk analysis and blockchain for climate finance tracking can enhance accountability and innovation.

Criticisms and Challenges

- Inadequate Adaptation Finance: Current flows focus on mitigation; adaptation and loss-and-damage financing remain underfunded.

- Regulatory Ambiguity: Lack of unified ESG investment norms deters institutional investors.

- Limited Domestic Instruments: India’s green bond market still trails behind global standards of disclosure and project certification.

- Dependence on External Capital: Excessive reliance on international loans raises concerns over debt sustainability.

- Equity and Access Issues: Smaller enterprises face procedural barriers and high cost of capital in accessing green funds.

Way Forward – Towards a Climate Finance Revolution

- Create a National Green Finance Framework with an integrated registry of sustainable projects and unified certification standards.

- Strengthen SEBI oversight on sustainability-linked bonds for transparency.

- Regional Climate Funds could finance sub-national projects in smaller cities and rural areas.

- Public–Private Climate Funds, similar to Green Climate Fund (GCF) models, can pool risk and enhance scale.

- Global Leadership Role: As ISA founder, India can push for a Global South Climate Finance Alliance advocating fair finance flows.

Conclusion

India’s clean energy rise offers global hope, but without equitable and scalable climate finance, the transition risks stalling. By leading climate finance innovation, India can align economic growth with planetary stewardship and social inclusion.

Mains Practice Question:

Q. What are the major challenges in mobilising adequate and equitable climate finance, and how can India strengthen its financing framework?. (250 words, 15 marks)

(GS Paper 3 – Issues Related to Direct and Indirect Farm Subsidies and Minimum Support Prices)

Context (Introduction)

The recent hike in wheat’s Minimum Support Price (MSP) to ₹2,585 per quintal—109% above its cost of cultivation—has reignited debate on whether MSP-driven price support truly enhances farmer welfare or distorts agricultural priorities.

The Policy Paradox

- Unjustified MSP Hike: Despite record public wheat stocks (33.3 million tonnes) and lower wholesale prices, MSP was increased by ₹160/quintal for 2025–26.

- Cost–Price Mismatch: The A2+FL cost (₹1,239/quintal) shows MSP is more than double production cost, far exceeding the mandated 50% profit margin.

- Crop Bias: Wheat and paddy receive procurement and import protection, while pulses and oilseeds get minimal support, distorting cropping patterns.

- Market Disconnection: India’s MSP-based price ($290/tonne) is much higher than global prices ($225–230/tonne), making exports uncompetitive.

- Fiscal Burden: High procurement, storage, and subsidy costs strain the exchequer and crowd out spending on rural infrastructure and innovation.

Challenges in the MSP-Based Approach

- Regional Concentration: Procurement benefits farmers mainly in Punjab, Haryana, and parts of MP, excluding the majority of smallholders.

- Crop Imbalance: Overemphasis on rice and wheat encourages unsustainable water and fertilizer use.

- Inefficiency in Distribution: FCI’s mounting stocks and wastage indicate poor alignment with real consumption needs.

- Global Price Distortion: High MSPs hinder agro-export competitiveness and may invite WTO disputes.

- Low Diversification: Farmers remain risk-averse to shift towards horticulture, pulses, or oilseeds, which the market actually demands.

Reforms and Way Forward – Income, Not Price Support

- Direct Income Transfers: Implement per-hectare cash support similar to PM-KISAN, ensuring predictable, equitable assistance.

- Decoupled Support: Shift from product-based MSPs to area-based income schemes, encouraging market-driven cropping choices.

- Strengthen Rural Infrastructure: Invest in warehouses, cold chains, irrigation, and digital markets (e-NAM) to reduce middlemen exploitation.

- Crop Diversification Incentives: Encourage nutri-cereals, pulses, and oilseeds through targeted subsidies and assured procurement.

- Price Stabilisation Funds: Use market intervention schemes and risk insurance rather than blanket MSPs to cushion farmers.

Criticisms and Considerations

- MSP Withdrawal Risks: Sudden removal without alternatives may hurt small farmers in food-surplus regions.

- Implementation Challenges: Land record inconsistencies complicate per-hectare transfers.

- Political Resistance: MSP enjoys symbolic and electoral significance, making reforms politically sensitive.

- Need for Coordination: Reforms require Centre–State collaboration under a clear agricultural transition roadmap.

Conclusion

True farmer empowerment lies not in inflated price supports but in assured income and resilient markets. Guided by NITI Aayog’s vision of Doubling Farmers’ Income and market reforms, India must transition from price-based protection to income-led, sustainable, and technology-driven agriculture.

Mains Practice Question:

- The Minimum Support Price system was designed to protect farmers but now risks distorting markets. Analyse the limitations of MSP-led support and suggest alternatives for ensuring stable farm incomes.(250 words, 15 marks)