Archives

IASbaba’s Daily Current Affairs – 29th January, 2016

ECONOMICS

TOPIC:

- General studies 3: Indian Economy and issues relating to planning, mobilization of resources; Banking & related Issues

- General studies 2: Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

Fashioning a Banking Turn- Public Sector Banks

- Looking at the India’s domestic macroeconomic situation, one might perceive that the economy is well ahead on its road towards growth and development but the sad reality is starkly visible- the banking sector continuously facing challenges due to the lack of any meaningful recovery in asset quality, capital constraints and sluggish profitability

- The Union budget thus, needs to incentivise savings to rescue public sector banks and come up with a proper backing of the policy and regulatory environment,

Indradhanush Scheme

Revitalising public sector banks (PSBs) has been a key focus area for policymakers and the Reserve Bank of India (RBI) and the Central government have put in place key enabling measures as under:

A) Appointments: Separation of the post of Chairman and Managing Director by prescribing that in the subsequent vacancies to be filled up, the CEO will get the designation of MD & CEO and there would be another person who would be appointed as non-Executive Chairman of the bank.

B) Bank Board Bureau: A Banking Boards Bureau (BBB) comprising of a chairman and six more members of which three will be officials and three experts (of which two would necessarily be from the banking sector). The search committee for members of the BBB would be made up of the RBI Governor, Secretary (Financial Services) and Secretary (Department of Personnel and Training) in the Government of India.

C) Capitalization: Rs 70,000 crore of equity support to be provided in phases during the next four years and another Rs 110,000 crore to be raised as debt from the markets. PSB’s market valuations will improve significantly due to

- far-reaching governance reforms;

- tight NPA management and risk controls;

- significant operating improvements;

- capital allocation from the government

D) De-stressing PSBs Government to push clearances for stalled projects in roads, power and steel and seek RBI support for more generous categorization of existing loans plus more leeway. Major reasons causing stress in the power, steel and road sectors were—

- Delay in obtaining permits/approvals from various governmental and regulatory agencies,

- Land acquisition,

- Delaying Commercial Operation Date (COD);

- Lack of availability of fuel, both coal and gas;

- Cancellation of coal blocks;

- Closure of Iron Ore mines affecting project viability;

- Lack of transmission capacity;

- Limited off-take of power by Discoms given their reducing purchasing capacity;

- Funding gap faced by limited capacity of promoters to raise additional equity and reluctance on part of banks to increase their exposure given the high leverage ratio;

- Inability of banks to restructure projects even when found viable due to regulatory constraints

- Steel sector: prevailing market conditions, viz. global over-capacity coupled with reduction in demand led to substantial reduction in global prices, and softening in domestic prices added to the woes.

Some of the actions proposed / undertaken:

- Facilitate issue of pending approval/permits expeditiously

- Evolve policies to address long-term availability of fuel for these projects

- Respective Discoms will be provided hand-holding towards enabling early reforms

- Bring in additional equity in an attempt to address the worsening leverage ratio of these projects

- Changing the extant duty regime without adversely impacting the downstream user industry (increased import duty on steel)

- Further flexibility in restructuring of existing loans wherever the Banks find viability.

E) Empowerment: There will be no interference from government to these banks so they can take their decision independently keeping the commercial interest of the organisation in mind

F) Framework of Accountability: A new framework of Key Performance Indicators (KPIs) to be measured for performance of PSBs— Indicators:

- Efficiency of capital use and diversification of business/processes

- NPA management and financial inclusion

- Strategic initiatives taken to improve asset quality,

- Efforts made to conserve capital,

- HR initiatives and

- Improvement in external credit rating

G) Governance Reforms: Banks to have robust grievance redressal mechanism for borrowers, depositors as well as staff— GyanSangam

- Strengthening of risk management practices

- No interference policy

- Improving HR management practices and removing barriers so that the Banks can share and work together on common resources

The upcoming budget session of Parliament— GEAR Approach

There is a need to boost savings in the economy in order to enhance the inherent economic strength of the financial sector via the Gear Approach to augment the savings rate:

- Growth

- Efficiency

- Attractiveness

- Reach

Enhance growth to increase per capita incomes—

- Need to increase disposable incomes by raising the personal income tax exemption slab to Rs 5 lakh.

- This could be a one-time correction and the slab could thereafter be linked to inflation and reviewed every three years.

Focus on improving the efficiency in financial transactions—

- Usage of plastic currency and e-transactions (via the internet and mobile phone) will not only improve the ease of transactions but also enhance the saving propensity among citizens

- Every 1 per cent reduction in the currency in circulation is likely to add 0.4 per cent to the savings rate

- Will also help curb the flow of black money

Make financial savings attractive by providing tax incentives—

- For instance, the tax exemption limits under Section 80C could be doubled to Rs 3 lakh which will deepen the mutual fund and equity markets

- Increase inflation-adjusted post-tax returns for bank deposits by reducing the lock-in period eligible for tax rebate to one year from five years

- Enhance the threshold for mandatory tax deduction at source (TDS) on interest income to Rs 50,000 a year from the current level of Rs 10,000; will prove to be useful to roll back TDS on recurring deposits to encourage wider adoption, as this is a product that promotes the habit of regular saving

- The National Pension Scheme should enjoy “EEE” (exempt, exempt, exempt) tax status

Expand the financial reach— Government could consider converting India Post into the postal bank of India, a full-fledged payments and savings bank, to leverage its rural penetration for greater financial inclusion.

Other Measures—

- Passage of the GST bill

- Further rationalising direct taxes, tax sops for start-ups

- Introduction of key structural reforms in terms of real estate, labour, and micro, small and medium enterprises

- Help to the farm sector that needs significant focus on irrigation and technological support.

- The bankruptcy bill will also turn out to be a game changer for spurring economic activity and confidence

- Advent of the JAM (Jan Dhan, Aadhar, Mobile numbers)

Jan DhanYojana: Furthering the objective of financial inclusion

Aadhaar Platform: Furnish the much-needed basic digital intelligence and mobile phones will leverage this through innovative payment systems, such as Immediate Payment Service or IMPS.

NATIONAL

TOPIC: General studies 2:

- Important aspects of governance, transparency and accountability, e-governance- applications, models, successes, limitations, and potential; citizens charters, transparency & accountability and institutional and other measures; Role of civil services in a democracy.

Impersonal government is good: A case of RTI act, 2005

- India’s RTI Act, which completed its first decade of implementation this year, is arguably one of the world’s most widely used freedom of information acts.

- In one year alone (2011-12), over two million requests were submitted to the Central government and in 10 of India’s 29 states.

Attacks on RTI activists:

- Choosing to file an RTI is not always a safe act.

- RTI activists are vulnerablehuman rights defenders (HRDs) in India.

- Unlike other HRDs, a majority of the RTI activists are not part of an organisation; they often act alone, moved by anger at corruption and other illegal activities.

- RTI activists are vulnerable because they live in the same areas as public authorities and political leaders who do not want information about their activities to be disclosed.

- Exposing corruption can make you enemies, and accounts of RTI users and activists being threatened, harassed, even assaulted or killed as a result of their requests.

- A lot of such cases has been witnessed in India in the past and is still continuing.

How can it be checked?

The Asian Centre for Human Rights recommends that a separate chapter, “Protection of those seeking information under the (RTI) Act”, be inserted into the RTI Act.

Protection measures should include

(a)mandatory, immediate registration of complaints of threats or attacks against RTI activists on the First Information Report and placing such FIRs before the magistrate or judge of the area within 24 hours for issuance of directions for protection of those under threats and their family members, and periodic review of such protection measures;

(b)conducting inquiry into threats or attacks by a police officer not below the rank of Deputy Superintendent of Police/Assistant Commissioner of Police, to be concluded within 90 days; and

(c)trial of the accused within six months.

(d)Further, concerned Public Information Officers, First Appellate Authorities and those directly related with the information sought under the RTI Act should be presumed to have abetted the offenses against the RTI activists unless evidence proves otherwise.

RTI starts its second decade: What is the need?

- The RTI and other freedom of information laws around the world are examples of how governments offer transparency, but passively.

- The citizens are the active agents, filling out request forms and, in the process, often dealing with resistance and delays.

- As the RTI starts its second decade, we need India’s government to ensure that information provision has a more impersonal face.

- This requires the government to invest in a data infrastructure that will allow it to go from passive to active transparency.

Open administrative datasets of government or active transparency:

In recent years, many countries have opened their administrative datasets to the public, with several goals in mind, like

- To make government more transparent and accountable,

- Track progress toward performance targets, and

- Help policymakers and administrators do their jobs effectively.

Difference between active and passive transparency:

In passive transparency government by itself does not provide any data to citizens unless until asked by them.

In case of active transparency government through suo moto initiative tries to provide administrative information to citizens without it being asked.

How does active transparency help?

- Active transparency brings huge benefits to citizens who can directly access data without filing requests.

- Citizens also benefit indirectly as researchers begin to use this data for a range of purposes, including to evaluate policy.

Measures to foster active transparency across ministries:

- Invest in technical inputs.

- The government can improve its digital services, especially website speed, by increasing the use of open-source technologies, which avoid costly licensing fees that can create procurement bottlenecks, and by taking advantage of efficient cloud web-hosting services.

- Encourage collaboration between policymakers, researchers and technicians from the word go.

- Researchers should not just provide answers, they should sit down with policymakers to help formulate the question.

- Technicians should help designing the model that developed by researchers and policy makers.

- Employ “agile”(able to remove quickly) methodologies.

- Software developers should use “agile” methodology to keep fast-moving projects from going astray(deviated) and creating waste.

- Using a clearly defined set of user needs, the developers should try to create prototypes and proceeds through short rounds of cooperative iteration.

- This method can benefit a wide range of government initiatives by keeping all sides informed and involved, and the project on track.

Way ahead:

- The Sustainable Development Goals (SDGs) include Goal 17 on revitalising the global partnership for development.

- This includes efforts “to increase significantly the availability of high-quality, timely and reliable data”.

- Although it is the last goal on the list, it would enable us to track progress on all the others.

- The more real-time data we have, the earlier we can correct ourselves and set a path toward goals that will improve the lives of individuals.

Connecting the dots:

- Critically examine the functioning of RTI act in the past decade.

- RTI act even though termed as successful, have severe lacuna. Examine the various lacunas present in the RTI act 2005. Suggest measures to reform the same.

MUST READ

Note: A article on Taliban and regional stability of Afghanistan will be published tomorrow

China’s long game in West Asia

Who benefits when the RBI cuts rates?

Mounting grievances, little regulation

Solar Scam: Oommen Chandy must resign

Homegrown energy security for Europe-Europe’s energy security is likely to gain salience in the coming months, as 2016 shapes up to be another turbulent year in international politics

MIND MAPS

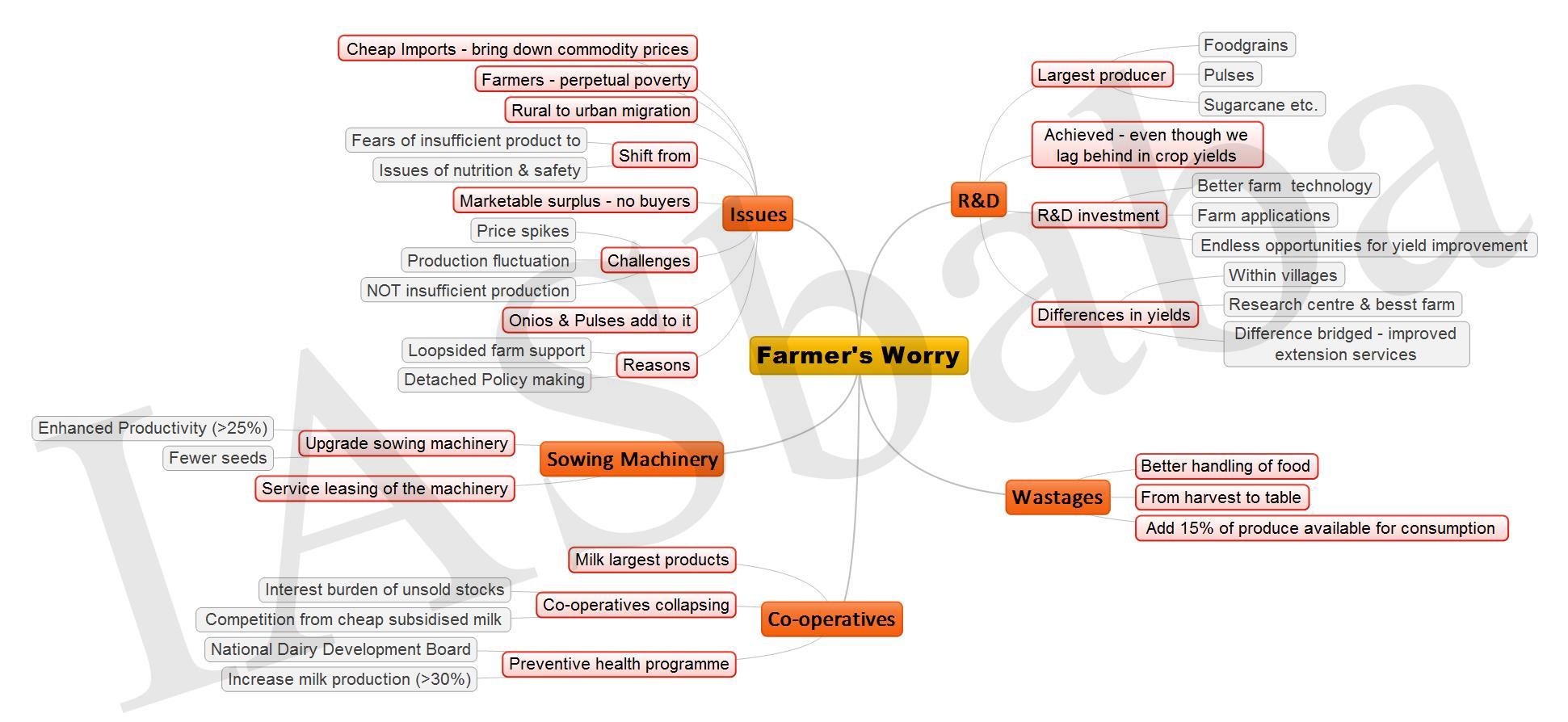

1. Farmer's Worry

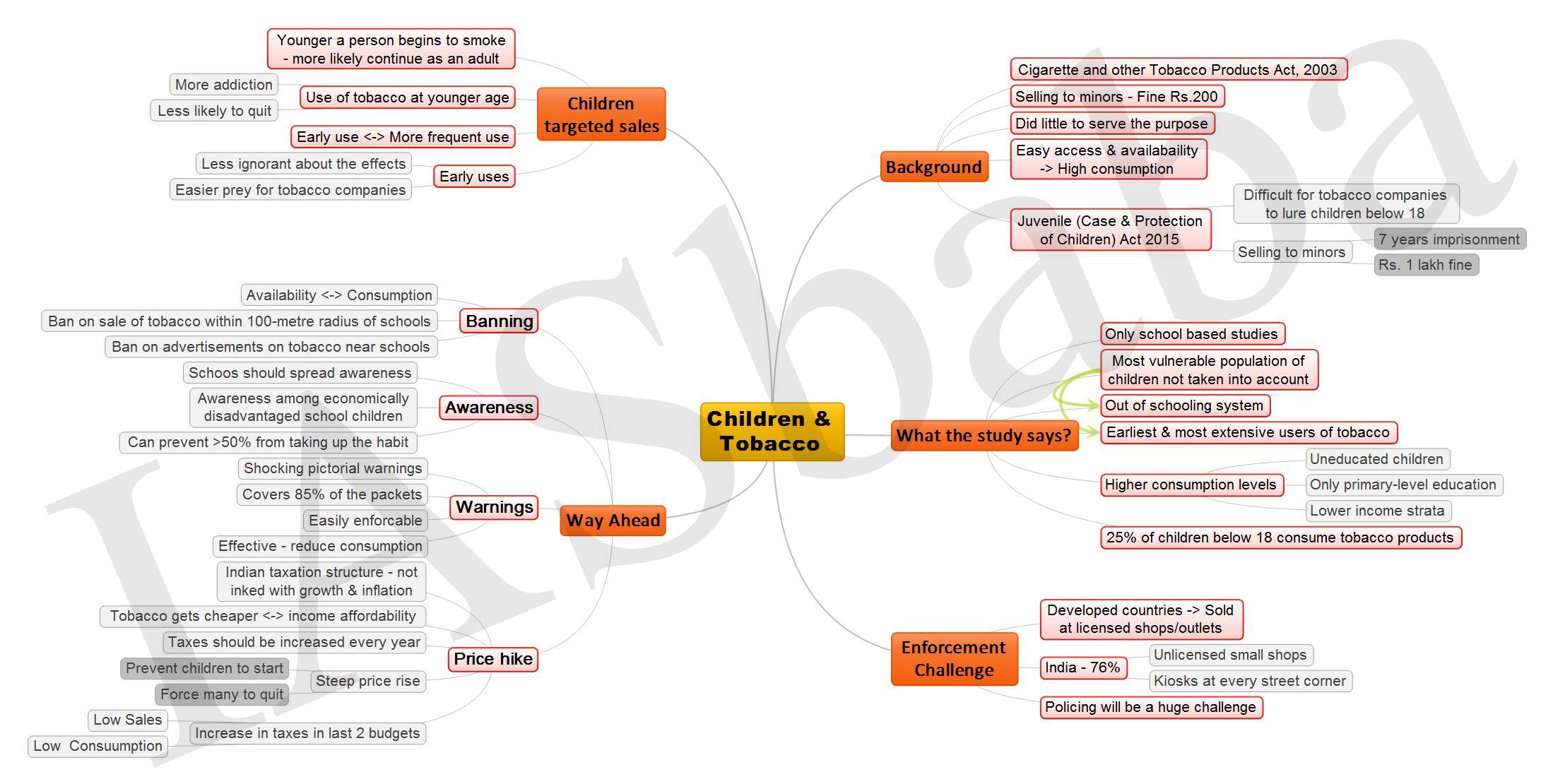

2. Children & Tobacco