IASbaba’s Daily Current Affairs – 9th June 2017

Archives

ECONOMY

TOPIC: General Studies 3

- Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment.

- Inclusive growth and issues arising from it.

The growth track is near

In news: Recently, the National Income for 2016-17 were released. The data forms a part of the 'Provisional Estimates of Annual National Income 2016-17 and Quarterly Estimates of Gross Domestic Product 2016-17' released by the Ministry of Statistics and Programme Implementation

- India's per capita income grew by 9.7 per cent to Rs 1,03,219 in 2016-17 from Rs 94,130 a year ago.

- In 2015-16, the growth rate of India’s per capita net income was 7.4%

- India’s Gross National Income (GNI) at 2011-12 prices was estimated at Rs 120.35 lakh crore during 2016-17, against Rs 112.46 lakh crore a year ago.

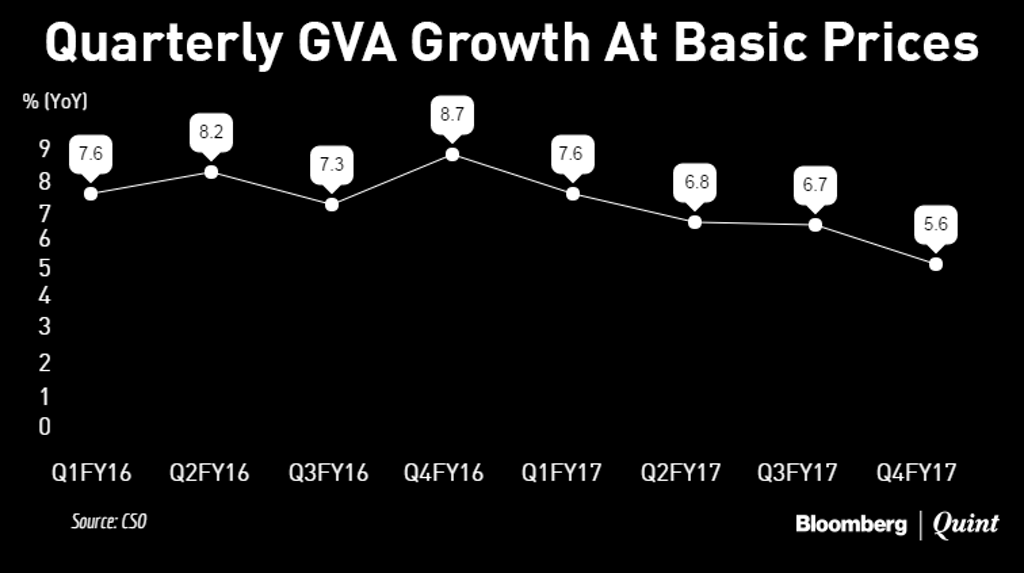

- The gross value added (GVA) growth slowed sharply in the fourth quarter to 5.6 percent, compared to 6.7 percent in the third quarter.

- Growth in the fourth quarter of fiscal 2017 is also much lower than the 8.7 percent growth reported in the fourth quarter of fiscal 2016.

National income is hard to estimate, particularly in economies like India where the informal sector accounts for much activity and employment, thus making difficult to capture official data.

- The growth rate of every quarter has been sliding from the previous quarter.

- During Q4, only two sectors- agriculture and public administration- have shown strong growth

- Construction and trade, hotels, transport and communication have shown a sharp decline in Q4. These are the sectors which use cash extensively.

Demonetisation impact:

- The overall growth rate of GDP is 6.1%, which is nearly 1% below the growth rate for the previous quarter at 7%.

- The liquidity crunch brought about by inadequate availability of currency consequent upon demonetisation must have impacted a lot of activities, especially such as housing and construction.

- No doubt, demonetisation would have had a short-term disruptive effect which would adversely affect growth.

- The long-term benefits in terms of a change in mindset and behaviour of people and greater use of technology-driven payments system can be analysed only in future.

However, there are other factors too which had an impact in growth.

Rate of Investment

- The most disturbing aspect of the data just released is the continuing decline in the Gross Fixed Capital Formation (GFCF) rate as proportion to GDP. It is steadily declining and in 2016-17 it fell to 29.5% from 30.9% in 2015-16. During high growth period, it was 33%.

- Though attempts have been made to raise public investment and also improvement in efficiency in the use of capital. This has led to significant improvements in the output of coal, power and roads.

Job generation

- It has been modest in past few years.

- Growth can happen because of greater utilisation of existing capacity or new investment.

- For this, there is a need to bring in new investment which will push growth and generate greater employment.

- Of course, there will be many factors such as technology that play a key role in determining the level of employment, but the investment needs a boost.

Burden of debt

- The Indian banks and businesses are extensively suffering under the debt burden.

- The health of the banking system is closely aligned to the health of the private sector business, both corporate and non-corporate.

- There is a need to quickly resolve the bank problems, especially the NPAs that will enable the banks to restart their lending programme in a big way and help business to embark on new investment.

Policy implications

- For a sustained high growth, there is a need of policymakers to shift their focus towards increasing the rate of investment in India. Though FDI in India is high, the rate of growth of fixed capital formation has been weak. With the reforms agenda being pushed forward, Bankruptcy Code becoming operational, implementation of GST, these are welcome steps.

- The slowdown in economy will put pressure on RBI to explain its stance on tight monetary policy. The CPI has pegged inflation at 3%, well below RBI’s medium term target of 4 percent. Thus, the lower-than-expected inflation, together with weakening growth, could prompt calls for a relook at the RBI’s policy stance.

- Adequate remonetisation should be done quickly to eliminate the adverse effects caused by shortage of currency. Though decreased use of currency is desirable, it should not be assumed show and resultantly reduce the supply. Many of the informal sectors, rural population, poor people, senior citizens are using cash as means of transaction.

Conclusion

While the adverse effects of demonetisation on GDP are clearly seen, it is difficult to decipher how much of the decline in growth rate in the January-March quarter is due to demonetisation and how much due to the underlying declining trend.

The macroeconomic stability parameters are in good shape with prices being in control. The central government’s fiscal deficit target is being adhered to as mentioned in budget.

With the monsoons expected normal in 2017, it is the most appropriate time to convert sentiment to firm action with a big push on private investment. Along with it, social harmony and law and order also are the pre-requisites for faster growth and hence shouldn’t be ignored in race to achieve high growth.

Connecting the dots:

- What are the challenges in front of Indian economic growth? Discuss sustainable ways to surpass them.

NATIONAL

TOPIC:

General Studies 3:

- Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment.

- Government Budgeting, Taxation & its impact

General Studies 2:

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

Providing safety-net: Pension for all

Issue:

According to a recent report by the World Economic Forum, the retirement savings gap in India is estimated to escalate to $85 trillion by 2050. And as most people in India do not have any kind of insurance and, as the population ages, it will also be pension less. The retirement savings gap will not only affect the quality of life of retirees, but can also pose macroeconomic challenges. As the proportion of retirees rises in the population, a shortfall in retirement income will affect consumption and growth. It will also affect fiscal sustainability as governments will have to spend more on retirees even in countries that do not have a state-funded retirement system.

What is NPS? NPS (National Pension System) is a defined contribution based Pension Scheme launched by Government of India with the following objectives-

- To provide old age income

- Reasonable market based returns over long run

- Extending old age security coverage to all citizens

It is based on a unique Permanent Retirement Account Number (PRAN) which is allotted to each Subscriber upon joining NPS.

What is required?

In order to improve financial security the policymakers should focus on three key areas—

- Providing a safety- net pension for all.

- Improving access to retirement plans

- Encouraging initiatives to increase the rate of contribution.

Providing safety-net pension for all:

It should be the responsibility of the government to provide a pension income for all citizens that acts as a ‘safety net’ and prevents those who miss out on other forms of pension provision from dropping below the poverty line.

Challenges:- Fiscal constraints. The biggest problem for India is that about 90% of the workforce is in the unorganized sector and lacks proper access to retirement-saving instruments.

- The pension challenge in India will be fairly acute. According to the UN Population Division, the share of population aged 60 or above will rise to 19% by 2050, compared with 8% in 2010.

- Even those who are investing may not be aware how much money they will need after retirement and what it takes to attain that goal. People generally lack the ability to make complex calculations and give more importance to their near-term needs than a longer-term requirement like retirement saving.

Steps taken by government:

- A pension regulator was established in 2003.

- New government employees (except in the armed forces) have been moved to a defined contribution-based National Pension System (NPS) from 2004.

- The NPS was opened to all citizens on a voluntary basis in 2009 and the government offers tax benefits to contributors.

- Budget 2014-15 had announced such a scheme, post which Life Insurance Corporation of India (LIC) had launched its single premium Varishtha Pension Bima Yojana. That scheme collected over R7,000 crore and offered lifelong pension at 9.3% per annum, providing monthly pension of R500-5,000.

- Union finance minister Arun Jaitley, in his 2015 budget speech, announced steps for creating a social security system. This included insurance and pension schemes, mostly for the underprivileged segments of society.

Recent developments:

A new Rs 5,000-crore pension formula is in process. It is expected to benefit more than five million central government employees. The new formula will calculate pension based on the latest drawn salary for a particular post.

The new method was fixed by an empowered committee of secretaries (Ecos) headed by secretary (pensions).

The seventh pay commission recommended that pension could be calculated by two methods:

- Pension would be 50% of the last salary and multiplied by 2.57.

- An incremental method where pension was fixed at the last salary drawn with adjustments of increments drawn in that particular pay band.

However, the incremental method was found to have lacunae as 20% of records were found to be missing in various government departments, and officials felt this could lead to litigation in future.

To avoid legal hurdles, the Ecos came up with the pay fixation method.

What more needs to be done?

- Creating awareness: Both the government and the makers of retirement products must place adequate emphasis on spreading awareness.

- The pension products must be simple and easily available.

- Technology can play a big role in making products available to savers.

- In India, generating more employment in the formal sector will help address the problem to some extent.

- As the government lack fiscal space, we will need to work on increasing retirement savings. Mobilizing savings for retirement could be a big opportunity as it would provide long-term solution.

Connecting the dots:

- As per a UN report the share of population aged 60 or above will rise to 19% by 2050 in India. Discuss the challenges related to the pension for the aged population given fiscal constraint of the government. Outline steps taken by government in this regard. Also elaborate on what more needs to be done.

MUST READ

Terror in Tehran

Clouded coherence

Unease of doing business

Fields of unrest

Time to talk

Real freedom of religion

Managing the RBI- Finance ministry rift

OBOR has no basis in China's history

The republic of compromise

The age of blow back terror

Aghan mini-surge has a strategy deficit

Three years of promise kept and violated

For a callibrated approach to reforms